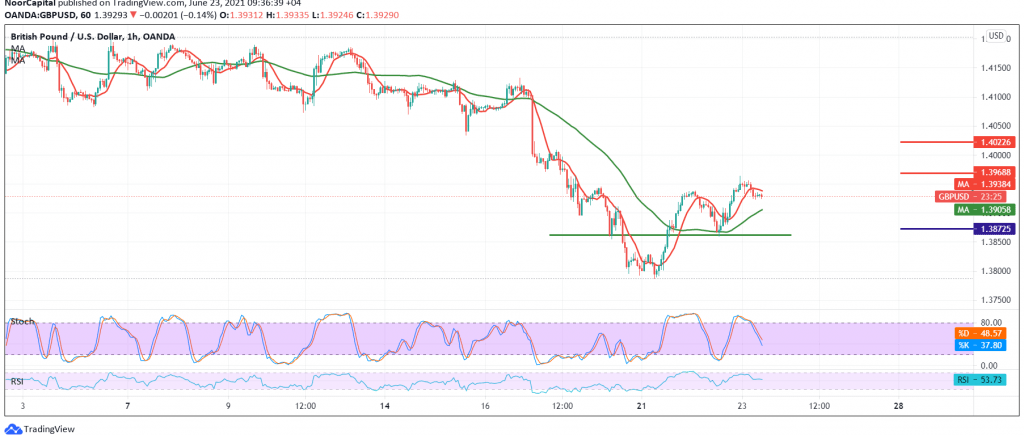

The British pound showed a slight bullish tendency after it managed to breach the pivotal resistance level published during the previous analysis at the psychological barrier of 1.3900, explaining that this might increase the chances of a touch of 1.3965, to succeed in touching the desired target, recording the highest price of 1.3963.

On the technical side, the intraday trading is stable above the 1.3890 support level, which is accompanied by the positive motive for the 50-day moving average on the 60-minute time frame.

Therefore, the bullish bias is more preferable, but with caution, provided that the breach of 1.3960/1.3965 is confirmed, and that is a catalyst that enhances the chances of rising towards 1.4020 and 1.4075, respectively.

To remind that activating the bullish slope requires stability above 1.3880/1.3870, and breaking it is capable of thwarting the bullish bias completely and leading the pair to the official descending path with an initial target that starts at 1.3810 and extends later to visit 1.3765.

| S1: 1.3870 | R1: 1.3975 |

| S2: 1.3810 | R2: 1.4020 |

| S3: 1.3765 | R3: 1.4075 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations