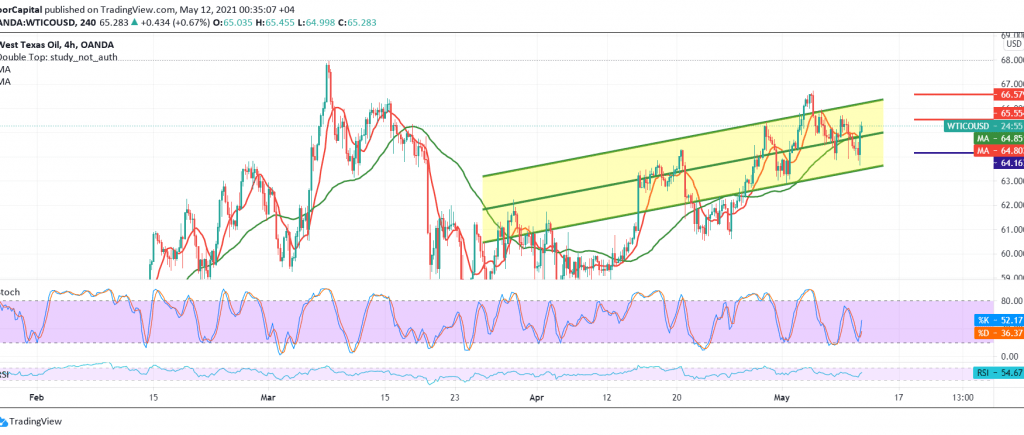

Negative trading dominated the price movements of US crude oil futures within a bearish context, as we expected touching the first target located at 64.00, to record its lowest level during the previous session’s trading at 63.67.

Technically, and by looking at the interval chart, we find oil is trying to stabilize above the support level of 64.60, and we find signs of a positive cross that started appearing on the stochastic indicator.

Therefore, we may witness a bullish bias during today’s session, but provided that we witness a clear breach of 65.50, targeting 66.00 as a first target, and the gains may extend later towards 66.60.

From below, oil failed to breach the aforementioned resistance and returned to trade again below 64.60, and most importantly 64.20. Therefore, oil may resume the bearish path with a target of 63.10, and then 62.50.

Warning: We are awaiting the report issued by the International Energy Agency regarding oil inventories, and we may witness high volatility in prices.

| S1: 64.20 | R1: 66.00 |

| S2: 63.10 | R2: 66.60 |

| S3: 62.45 | R3: 67.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations