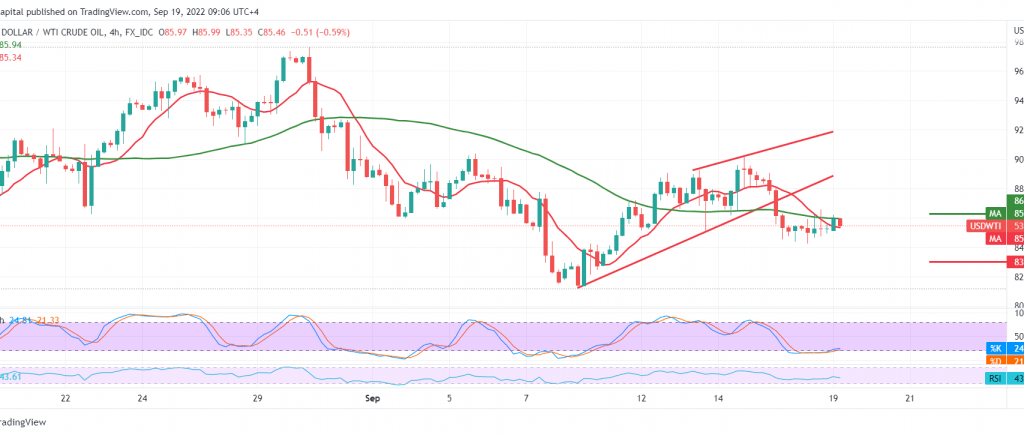

Negative trading dominated the US crude oil futures prices within the expected bearish path at the end of last week’s trading. It was heading towards the official target of 84.40, recording its lowest level of $84.30 per barrel.

Technically, by looking at the 4-hour chart, we notice that Stochastic is losing bullish momentum and supports the continuation of negative pressure from the 50-day simple moving average, which constitutes a negative pressure factor on the price from above.

Therefore, with the stability of trading below the resistance level of the previously broken support-into-resistance of 86.00 and most importantly 86.30, the bearish tendency is the most likely, targeting 84.30 and breaking it increases the strength of the bearish bias, opening the door toward 83.20, next waiting station.

Note: The RSI is trying to get positive signals on the short time frames that might push the price to achieve some intraday gains before pulling back.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations