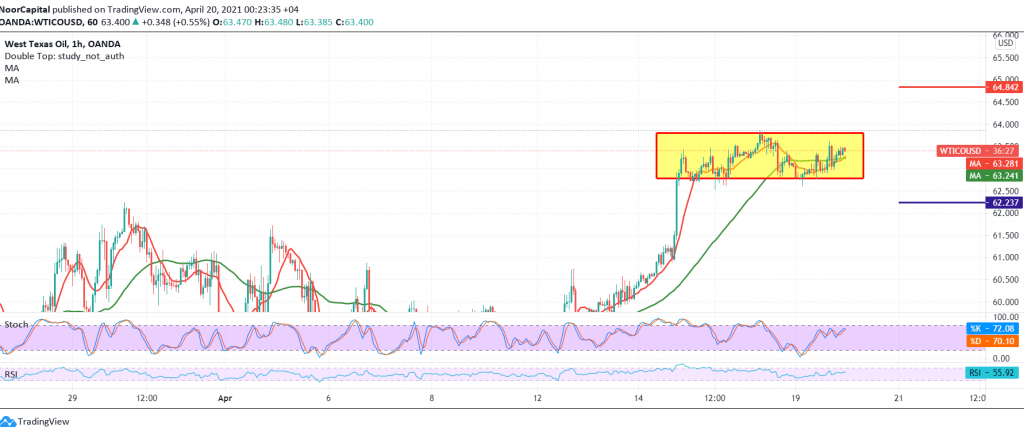

Narrow range sideways trades dominate US crude oil futures prices, narrowing from the top below 63.80 and from below above 62.80.

Technically, with a closer look at the 60-minute chart, we find the RSI indicator began to provide negative signals, and this coincides with the stability of the intraday trading below 63.80.

Therefore, we believe that there is a possibility of a bearish bias during today’s session targeting 62.80/62.60 the first target, knowing that the confirmation of the last break may extend oil losses so that the way is open directly towards 62.20.

From the top, crossing to the upside and rising above 63.80 leads the price once again to continue the official bullish path with the target of 64.25, and then 64.85.

| S1: 62.80 | R1: 63.80 |

| S2: 62.20 | R2: 64.25 |

| S3: 61.75 | R3: 64.85 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations