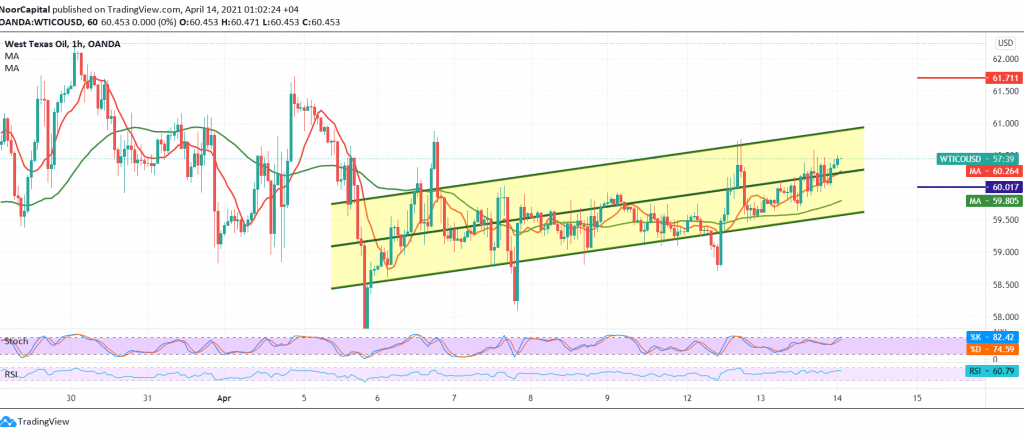

US crude oil futures prices witnessed positive trading, and as a reminder, we remained neutral in the previous analysis, waiting to be released from the sideways range, indicating that moving above the psychological barrier of 60.00 increases the probability of touching 60.75 to record the high of 60.58.

Technically, the intraday trading remains above 60.00, accompanied by the persistence of the RSI indicator defending the bullish bias in addition to the positive motivation coming from the 50-day moving average.

Therefore, we may witness an increase during the current session, targeting 60.75 and then 61.10, knowing that the recent breach is a catalyst that increases the possibility of touching 61.75.

From below, the price’s stability and stability below the support floor of 60.00 negates the activation of the suggested scenario, and the negative moves return to control oil to visit 59.00.

Note: IEA oil inventories are due today, and we may witness price fluctuation.

| S1: 59.25 | R1: 61.10 |

| S2: 58.10 | R2: 61.75 |

| S3: 57.40 | R3: 62.90 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations