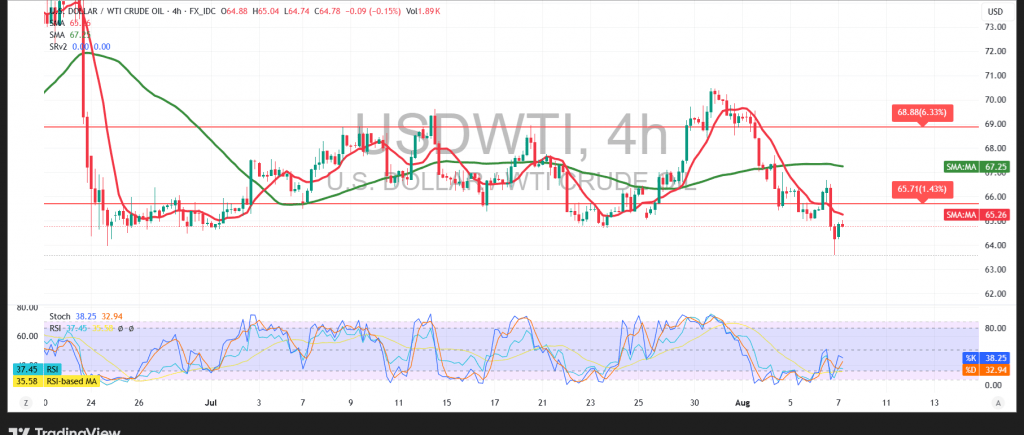

U.S. crude oil extended its losses as anticipated in our previous report, surpassing the initial downside target of $64.35 and recording a session low of $63.66 per barrel.

Technical Outlook:

Following multiple sessions of decline, oil prices are attempting a modest rebound, supported by price stabilization above the psychological threshold of $64.00. The recent low at $63.66 has acted as a short-term support level, while the 50-period Simple Moving Average (SMA) is beginning to offer dynamic support once again, suggesting a potential pause in the bearish trend.

However, caution is warranted as the Relative Strength Index (RSI) is approaching overbought territory, potentially signaling limited room for further upside in the immediate term—especially given that the broader downtrend remains dominant.

Likely Scenario:

Given the conflicting technical signals, it is advisable to monitor price action closely in the near term. Two key scenarios are in play:

- Negative Scenario:

A failure to hold above the $64.00 support level could reintroduce selling pressure. A break below $63.66 may accelerate losses toward $63.40, with a further decline possibly extending to $62.00. - Positive Scenario:

A confirmed breakout above the $66.45 resistance level could ease bearish momentum and trigger a corrective move, with $68.10 as the next upside target.

Warning:

Market risk remains elevated due to ongoing trade and geopolitical tensions. Traders should be prepared for high volatility and manage risk accordingly across all scenarios.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations