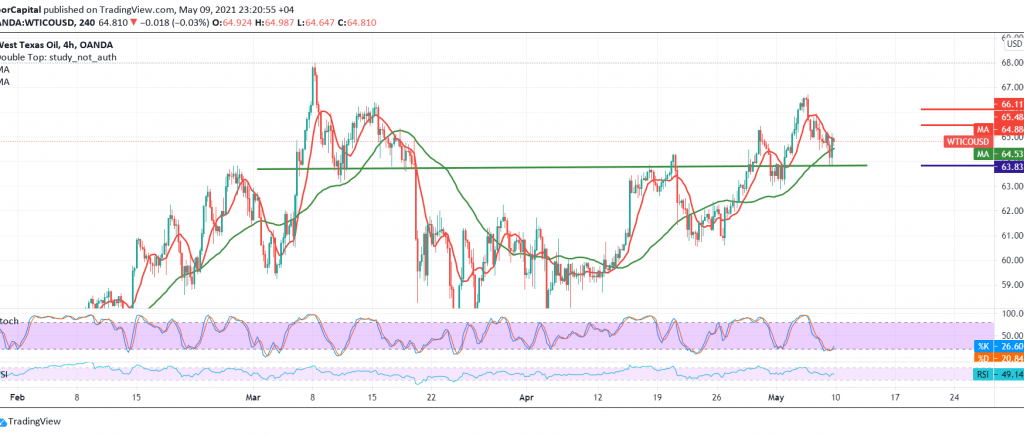

Negative trading dominated the futures price of US crude oil within the bearish context expected during the previous analysis at 64.20, recording its lowest level at 63.88.

Technically, we tend to be negative in our trades depending on the negative signals coming from the RSI, in addition to the intraday trading stability below the resistance level of 65.20/65.40.

Therefore, a bearish bias is likely today, targeting 64.10/64.00, and losses may extend later towards 63.70. The bearish scenario depends on trading remaining below 65.40, and a breach of it is able to thwart the suggested bearish scenario, and oil will recover again, with an initial target of 66.00.

| S1: 64.05 | R1: 65.40 |

| S2: 63.30 | R2: 66.00 |

| S3: 62.75 | R3: 66.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations