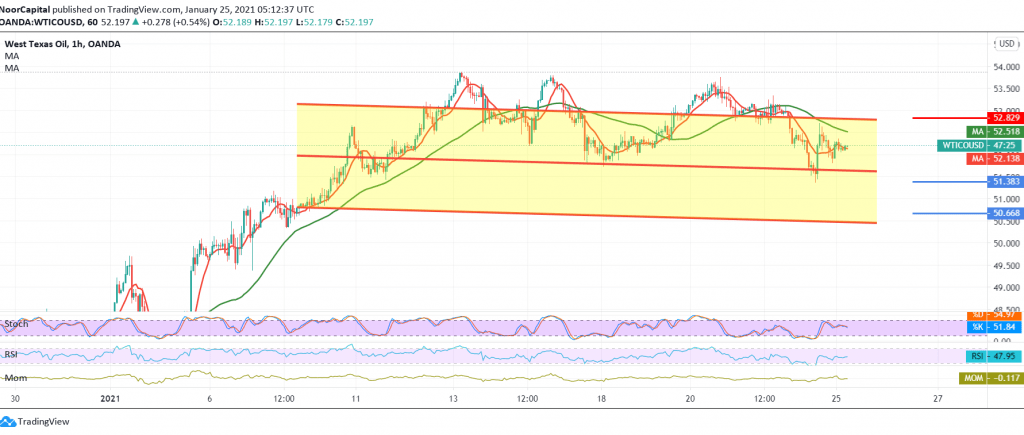

US crude oil futures prices retreated significantly at the end of last week’s trading, heading for touching the official target to be achieved at 51.40, recording its lowest level at 51.43.

Technically, despite the intraday positivity features, we tend to be negative in our trading, relying on trading remaining below the previously broken support level, which is now converted to the resistance level of 52.70 / 52.80, with the continuation of the negative pressure coming from the 50-day moving average.

Therefore, we will maintain our negative outlook, knowing that trading below 52.00 facilitates the task required to visit 51.50 the first target and break it increases and speeds up and confirms the strength of the daily bearish trend with the second target 50.75.

Only from the top is the return of trading to stability again above 52.80, and the most importantly 53.10 is able to completely defeat the suggested scenario, and oil will recover again, with the target of 54.00.

| S1: 51.50 | R1: 52.80 |

| S2: 50.75 | R2: 53.45 |

| S3: 50.15 | R3: 54.15 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations