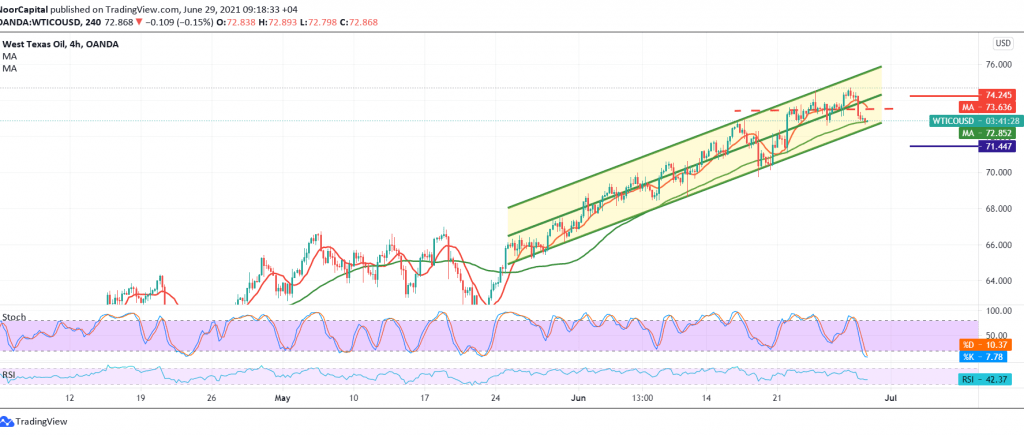

The current movements of US crude oil futures prices are witnessing a bearish tendency, after it succeeded in approaching by a few points from the first official target published during the previous report, 74.80, posting a high at 74.70, to return now within a slight stable bearish slope below 73.45. Trading below 73.54 puts the price under temporary negative pressure, targeting 72.65, recording the lowest price at 72.68.

Technically, trading stability below the psychological barrier of 73.00, and most importantly below 73.45, increases the possibility of witnessing a bearish corrective slope in the upcoming hours, with the breach of the bullish channel support shown on the chart.

We are targeting 72.10/72.00 as an initial stop, taking into consideration that trading below 72.00 puts the price under strong negative pressure to complete the bearish correction with the aim of retesting the pivotal support 71.40.

Only from the top, to surpass the upside and settling again above 73.45, which will stop the suggested scenario, and crude will recover again, with an initial target of 74.20.

| S1: 72.10 | R1:74.20 |

| S2: 71.40 | R2: 75.40 |

| S3: 70.10 | R3: 76.15 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations