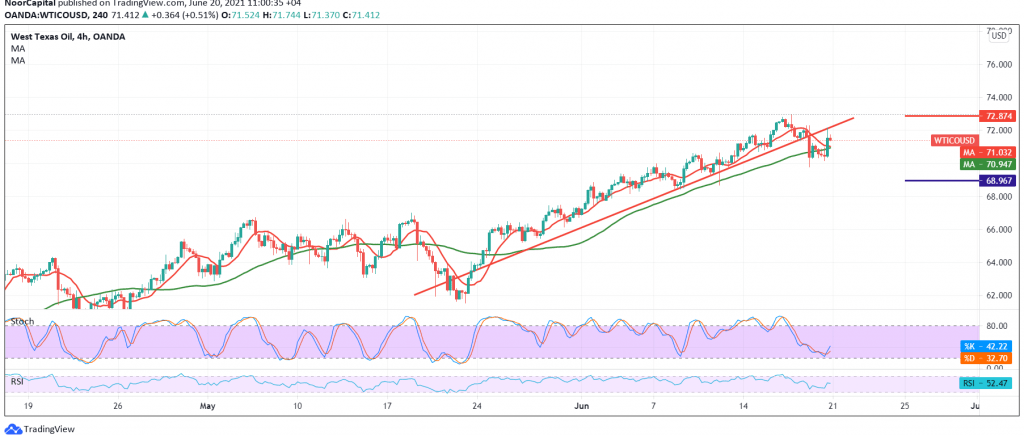

Negative trading dominates the US crude oil futures prices after it found a strong resistance level around 71.80.

Technically, the Relative Strength Index provides positive signals in addition to oil’s attempts to stabilize above the 50-day moving average, and this contradicts the negative signs that started appearing on the stochastic indicator.

With the technical signals conflicting, we will stay on the fence for the moment, waiting for one of the following scenarios: To get a bearish correction, we need to witness a break of 70.80 to target 70.00, an initial station, and breaking it puts the price under strong negative pressure to visit 69.00.

Reactivating the long positions requires that we witness a clear and strong breach of the resistance level 72.00, and from here oil may recover with an initial target of 72.80.

Note: the risk level appears to be high.

| S1: 70.00 | R1:71.95 |

| S2: 68.95 | R2: 72.85 |

| S3: 68.00 | R3: 73.90 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations