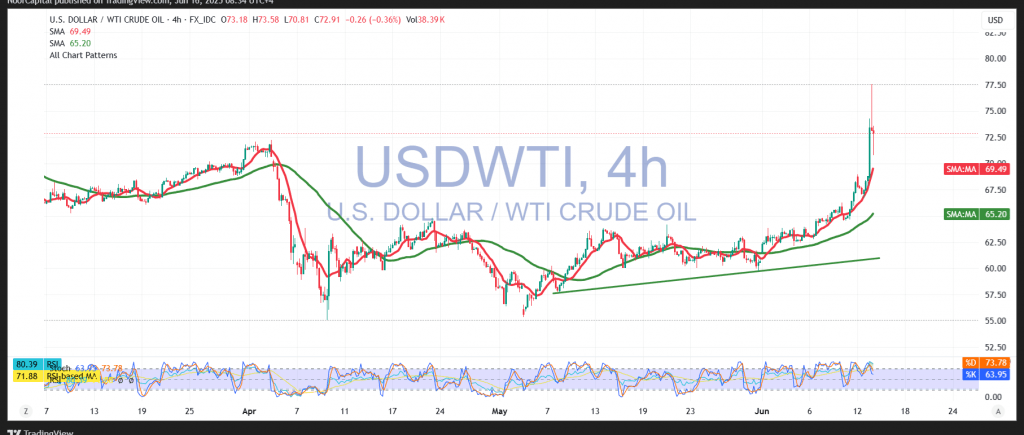

US crude oil futures posted their largest gains since March 2022, surging to a high of $77.57 per barrel as geopolitical tensions escalated, fueling fears of supply disruptions and boosting safe-haven flows into commodities.

From a technical standpoint, despite the profit-taking-driven intraday pullback, the overall trend remains decisively bullish. Overbought conditions reflected in momentum indicators suggest a temporary pause may occur; however, the presence of strong support from the ascending trend line and simple moving averages bolsters the broader bullish structure.

As long as oil prices maintain stability above $68.50 on at least an hourly close, the upward trend is expected to persist. A confirmed breach of $77.45 would likely act as a bullish trigger, opening the path toward $82.00. Sustained bullish momentum could extend gains further toward the $86.50 resistance level.

Reminder: A decisive move below $68.45 could invalidate the current bullish outlook and expose the market to deeper declines, potentially targeting the $64.00 level.

Warning: Given the prevailing trade and geopolitical risks, volatility remains elevated, and traders should prepare for swift market reactions to new developments.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations