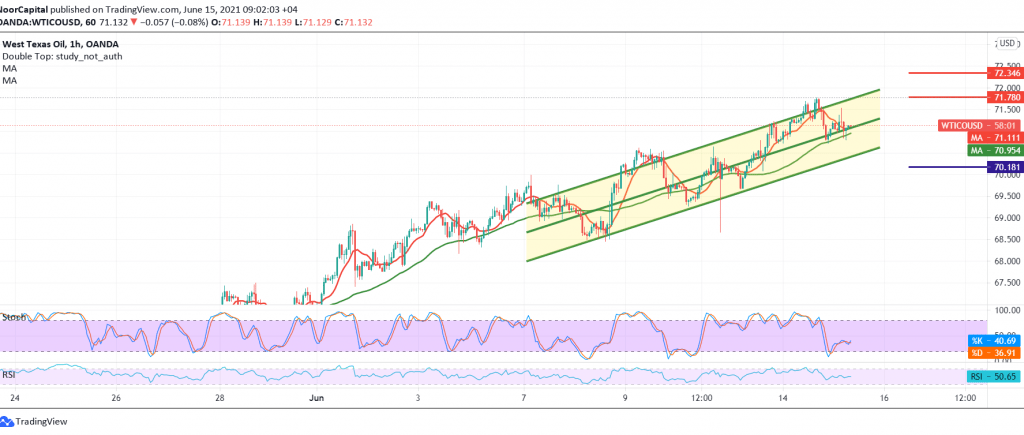

Positive trading dominated the movements of US crude oil futures prices at the beginning of this week’s trading, recording its highest level at 71.77.

Technically, oil prices found a strong resistance around 71.80, which forced it to trade with temporary negative again. The current moves are witnessing a bearish bias accompanied by the RSI losing the bullish momentum on the short time frames.

This increases the possibility of a slight bearish bias in the coming hours, targeting 70.70, then 70.25, a second target that may extend later to visit 69.70 before attempts to rise again.

Note: The bearish bias does not contradict the general bullish trend, whose official targets start around 72.20 as soon as the breach of 71.70 is confirmed.

| S1: 70.70 | R1:71.65 |

| S2: 70.25 | R2: 72.20 |

| S3: 69.70 | R3: 72.65 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations