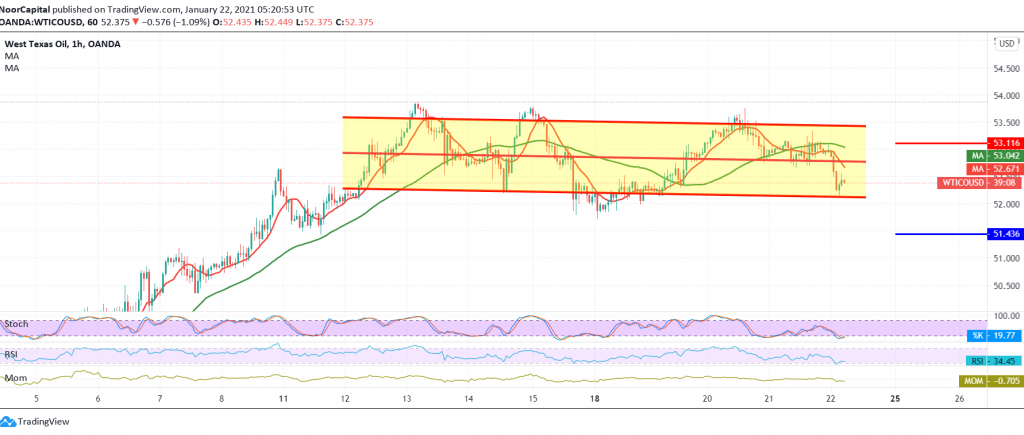

Negative trading dominated the futures price of US crude oil within the bearish context expected during the last analysis, touching the order of taking profits at 52.30, to record its lowest level at 52.15.

Technically, we tend to be negative in our trading, relying on the negative pressure coming from the 50-day moving average that meets around the previously breached support level of 52.70 / 52.80, in addition to the negative signs coming from the RSI.

We are targeting 51.90 the first target, and breaking it will extend oil losses, so we will be waiting for the next 51.40 goal to be touched. Trading above 53.10 to negate the bearish scenario and oil will recover again, with the target of 53.80.

| S1: 51.90 | R1: 53.10 |

| S2: 51.40 | R2: 53.80 |

| S3: 50.75 | R3: 54.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations