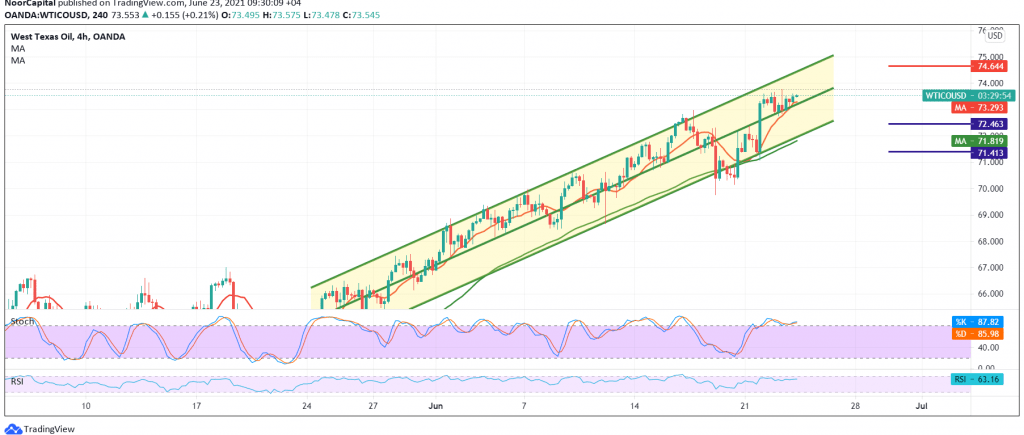

US crude oil futures prices continue their positive trading within the gradual ascent to the top, approaching the first official target that is required to be achieved during the previous report, 73.70, recording the highest level at 73.45.

Technically, the simple moving averages continue to hold the price from below, accompanied by the RSI gaining bullish momentum on the short time frames.

From here and steadily trading above the support level of 72.60/72.50, the bullish scenario will remain valid and effective, targeting 73.60, and then 74.00 next official station, taking into consideration that breaching the latter extends the oil gains so that the road is directly open towards 74.60.

To remind you that trading below 72.50 is able to completely thwart the suggested scenario and put the price under temporary negative pressure, targeting 71.60.

Note: Oil Inventories from IEA are due today, and we may witness high volatility in prices.

| S1: 72.60 | R1:73.60 |

| S2: 72.00 | R2: 74.05 |

| S3: 71.60 | R3: 74.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations