Positive trades dominate US crude oil futures prices within the expected bullish context within a gradual rise to the upside, recording its highest level during the previous trading session’s trading session of 66.50.

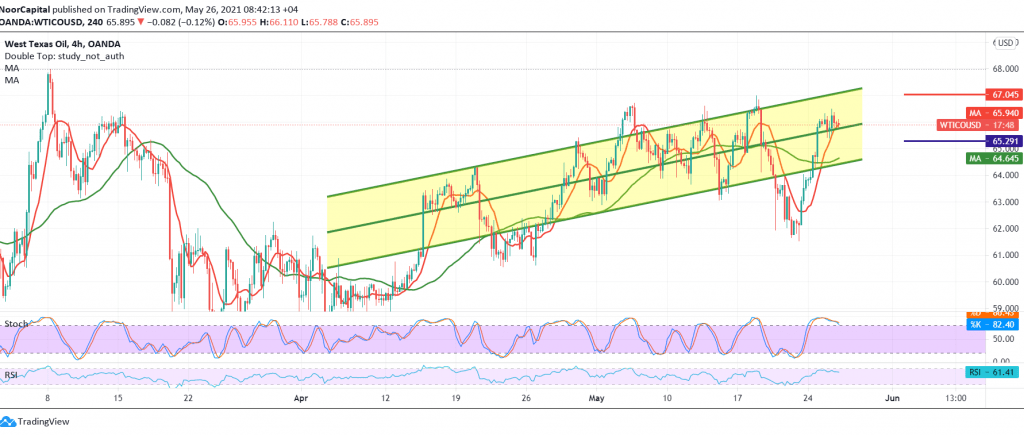

Technically, today we tend to positively in our trades by looking at the chart at a 240-minute chart, and we find the stochastic continues to get more positive momentum in addition to the positive stimulus coming from the simple moving averages that continue to hold the price from below.

The activation of long positions is still valid, but cautiously targeting 66.50, bearing in mind that the breach of the aforementioned level will extend oil’s gains, so the way is directly open towards 67.00/67.10.

The expected bullish bias requires oil prices to remain above the previously breached resistance, which has now turned to the support level of 65.40 / 65.30.

Note: RSI is providing negative intraday signals.

Note: Today, we are awaiting the report issued by the International Energy Agency later in today’s session, and we may witness high volatility in prices.

| S1: 64.35 | R1: 67.10 |

| S2: 62.60 | R2: 68.10 |

| S3: 61.65 | R3: 69.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations