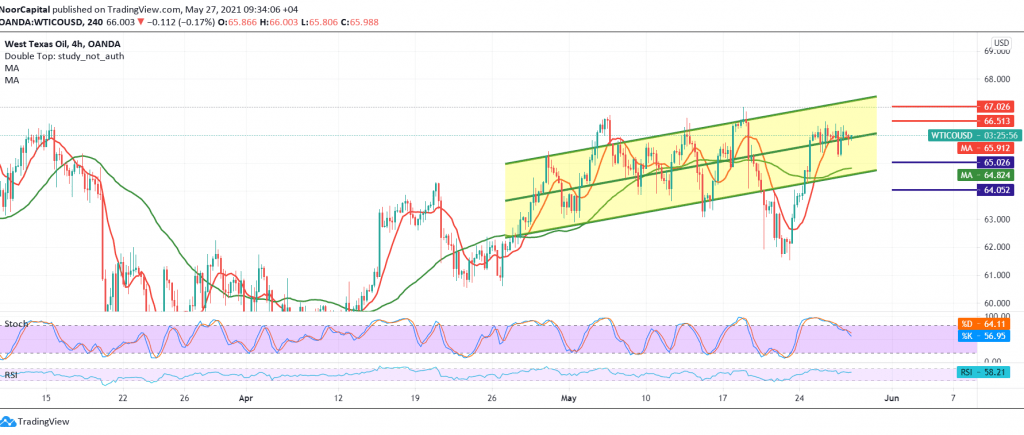

Positive trading continues to dominate US crude oil futures prices, a few points closer to the target published during the previous analysis, located at 66.50, to record a high of 66.40.

Technically, trading remains above 65.00 that supports the continuation of the rally, which is accompanied by the positive motive of the 50-day moving average. From here, with steady trading above 65.00, the bullish scenario remains valid and effective targeting 66.40/66.50 as the first target, bearing in mind that surpassing the upside of the pivotal resistance 66.50 increases and accelerates the upside move, so that we will be waiting for 67.00/67.10 an official station awaited.

A break of 65.00 is able to foil the bullish scenario and put oil prices under negative pressure, with the aim of re-testing 64.65, and then 64.20.

Note: there is a clear reversal of the bullish momentum.

| S1: 65.25 | R1: 66.50 |

| S2: 64.65 | R2: 57.00 |

| S3: 64.10 | R3: 67.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations