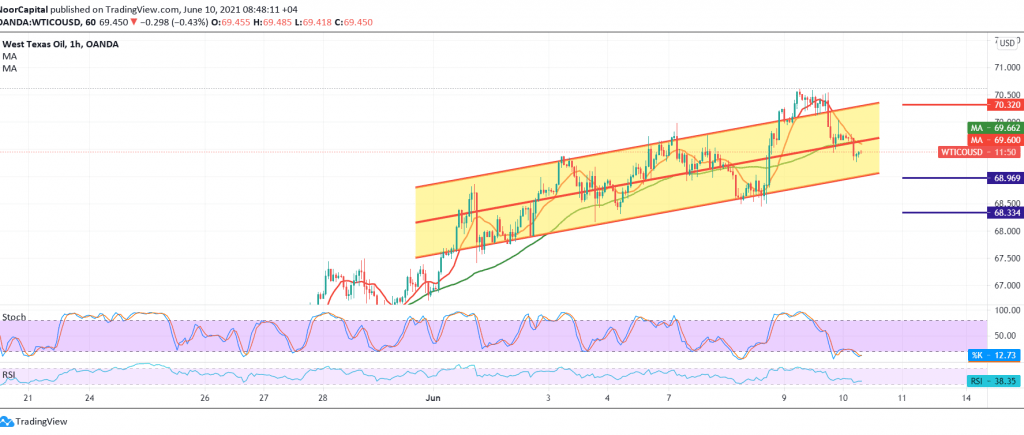

US crude oil futures prices achieved noticeable gains during the previous trading session, attacking the psychological resistance level of 70.00, to record the highest level of 70.60.

Technically, prices failed to stabilize for a long time above the 70.00 level, and we find the stochastic started to gradually lose the bullish momentum, accompanied by the negative signals from the RSI gaining the bearish momentum on the short time intervals.

Therefore, we may witness a bearish bias in the coming hours, targeting 69.00/68.90, a first target, taking into account that the price stability below the mentioned level puts the price under negative pressure, targeting a retest of 68.40.

Activating the bearish scenario depends on the intraday stability being below 70.00, and most importantly 70.30.

Note: the mentioned bearish bias does not contradict the general bullish trend, with official targets are located around 71.00 and 71.60 once the breach of 70.30 is confirmed.

| S1: 68.95 | R1: 70.30 |

| S2: 68.40 | R2: 71.10 |

| S3: 67.60 | R3: 71.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations