Negative trading dominated the US crude oil futures price within the expected bearish context, and it gradually approached the desired target of 61.20, to settle for recording its lowest price at 61.53.

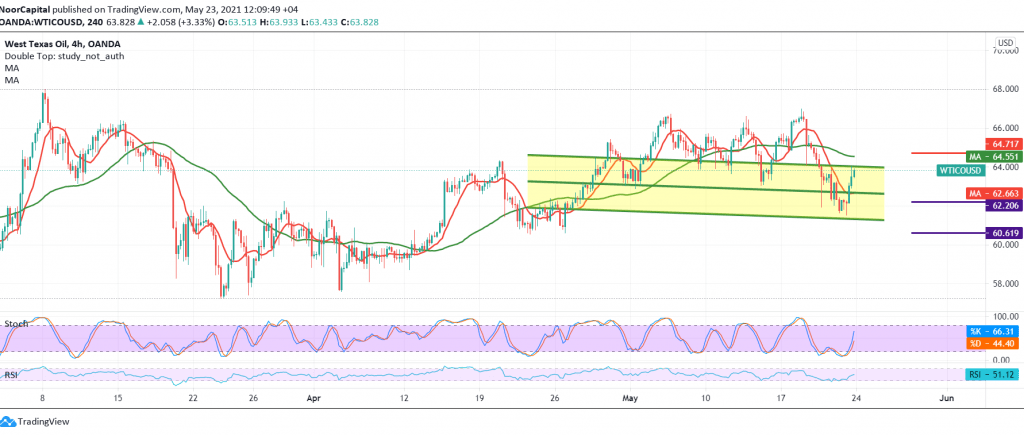

From a technical analysis standpoint, prices have rebounded significantly, benefiting from the support level of 62.25, and we notice the stability of the intraday movements above the psychological barrier 63.00 support, in addition to the positive signs coming from the RSI and stabilizing above the 50 midline.

Therefore, we may witness a bullish tendency during today’s session targeting the extended resistance 64.55/64.75 as a first target, and a breach of it is able to enhance the chances of an upside towards 65.65.

A reminder that the return of trading stability below 62.25 could completely defeat the bullish scenario and lead oil prices to trade negatively again, with the first target of 61.20, and then 60.65.

| S1: 62.25 | R1: 64.75 |

| S2: 60.65 | R2: 65.65 |

| S3: 59.75 | R3: 67.25 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations