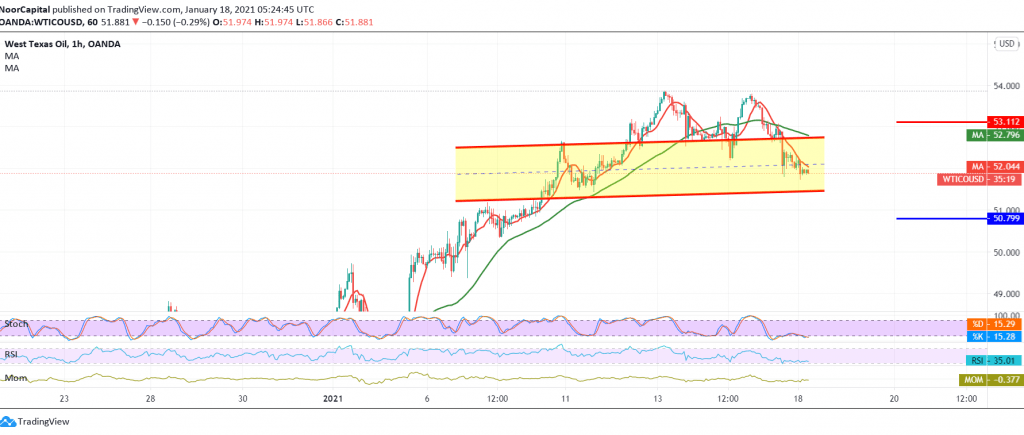

A gradual decline to the downside is dominating the movements of US crude oil futures, posting its lowest price during early trading for the current session at 51.80.

Technically, with the price’s success in breaking the support level of 52.70, which has now been converted into a resistance level according to the concept of role-swapping, we also find that the RSI indicator continues to provide negative signals.

Thus, the bearish bias is likely today, targeting 51.40 the first target, bearing in mind that breaking it extends oil’s losses so that the way is directly open towards 50.75.

A reminder that trading remains stable once again above 52.70 and most importantly 53.10 negates the activation of the suggested bearish scenario, and oil recovers again with the aim of re-testing 54.10.

| S1: 51.40 | R1: 53.10 |

| S2: 50.75 | R2: 54.10 |

| S3: 49.70 | R3: 54.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations