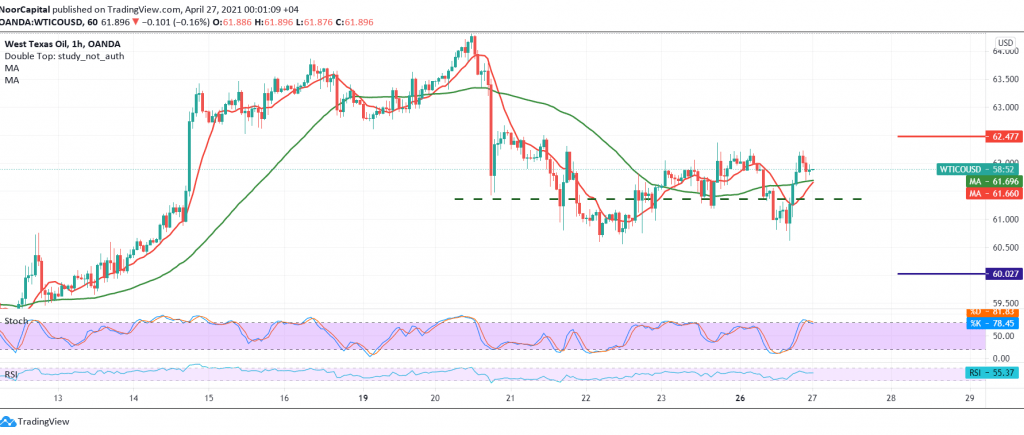

Mixed trades dominated the futures price of US crude oil after it witnessed a bullish rebound benefiting from the 61.30 support level within an upward slope approaching our first target published in the previous analysis at 62.50, to settle for its highest level at 62.24.

Technically, we tend to be positive today, depending on the price’s success in stabilizing above 61.30, accompanied by a positive motivation for the simple moving averages.

The bullish bias is likely today at 62.50 the first target, and a breach of it will extend oil’s gains, opening the way to a visit of 63.20/63.20.

From the bottom, the return of trading stability and stability below 61.30 is capable of foiling the suggested bullish scenario and puts the price under negative pressure, targeting 60.95, and then 60.00 a next official stop.

Note: The level of risk may be high.

| S1: 60.95 | R1: 62.50 |

| S2: 60.00 | R2: 63.20 |

| S3: 59.40 | R3: 64.20 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations