U.S. crude oil futures experienced mixed trading in the previous session after testing the psychological resistance level at $64.00, which effectively halted the upward momentum and capped further gains.

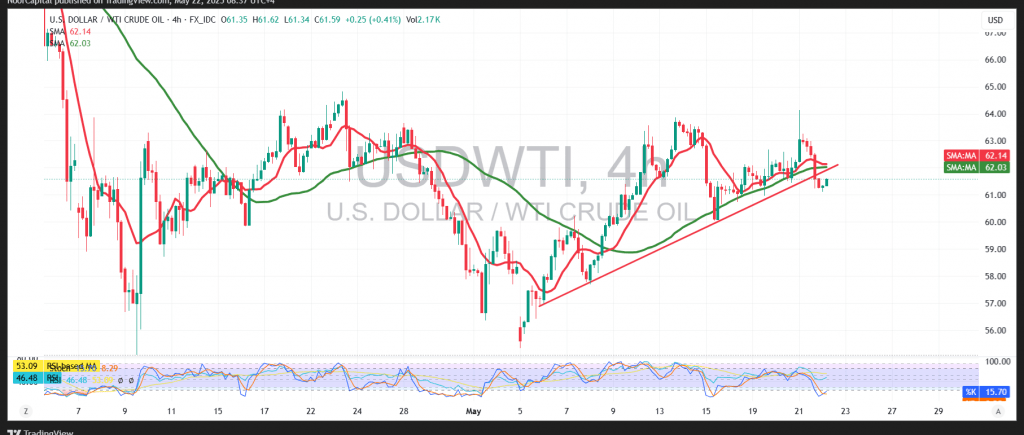

Technically, oil is now stabilizing around $61.60. A closer look at the 4-hour chart reveals that the price has broken below the lower boundary of the corrective price channel, signaling a shift in sentiment. This breakdown is reinforced by continued price action below the 50-period simple moving average, which is acting as dynamic resistance.

As long as intraday trading remains below $63.40, selling pressure is likely to persist. A confirmed break below $61.10 would strengthen the bearish outlook, targeting $60.45 initially. Further downside could extend toward $59.40, should momentum accelerate.

However, a return to stable trading above $63.40 would invalidate the bearish scenario in the short term, potentially leading to a recovery phase.

Key Event Risk Today:

Markets are bracing for high-impact economic releases, including Services and Manufacturing PMI data from the United States, Eurozone, and United Kingdom. These releases are likely to introduce significant volatility across commodities and broader financial markets.

Risk Disclaimer:

In the current environment of global trade tensions and key economic data releases, market risks remain elevated. Traders should maintain cautious positioning and prepare for potential sharp price swings.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations