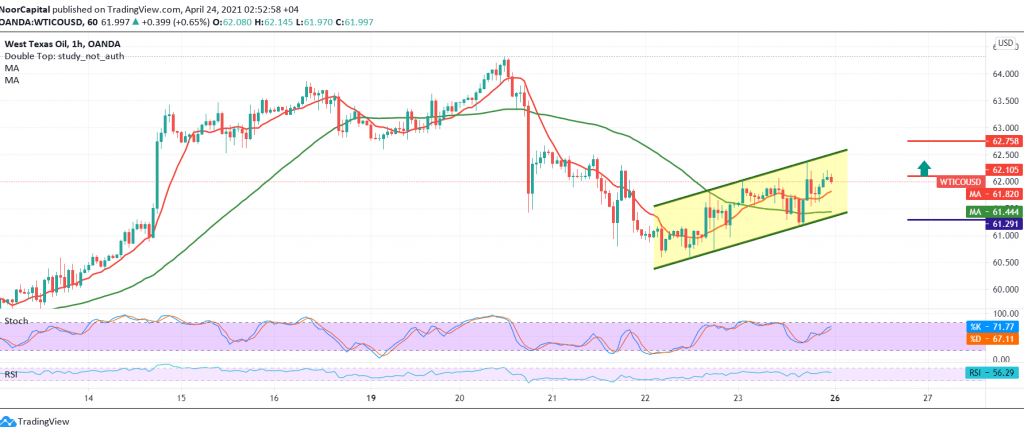

Positive attempts to control the futures movement in US crude oil returned after it failed to confirm the breach of the pivotal support located at 60.80, which is also stable above 61.30. Technically, the RSI indicator defends the bullish bias over short time intervals, coinciding with the positive stimulus of the 50-day moving average.

Despite the technical factors that support the possibility of the upside, we separate witnessing a clear and strong breach of the resistance level 62.10/62.20 to enhance trading opportunities around 62.50/62.70, initial targets and may extend later towards 63.00.

In the event that oil fails to breach the aforementioned resistance and returns to trade again below 61.30, then we return to preferring the negativity with the first target of 60.80, and the price should be carefully monitored around this level because a breakout leads oil to enter a downside wave with an initial target around 60.20/60.00.

| S1: 61.30 | R1: 62.50 |

| S2: 60.70 | R2: 63.05 |

| S3: 60.20 | R3: 63.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations