US crude oil futures prices succeeded in achieving the positive outlook, as we expected touching the first official target published during the previous analysis at 53.00, to record its highest level at 53.17.

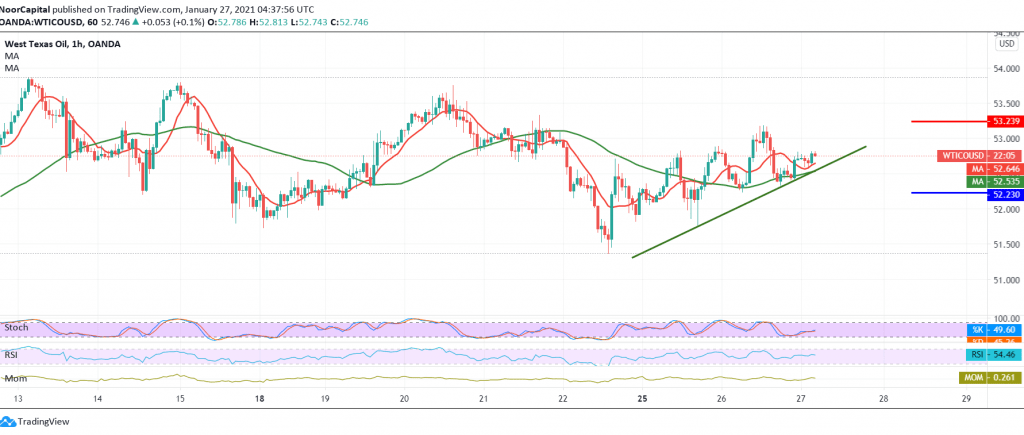

Technically, the current movements are witnessing a downward easing tendency as a result of a collision with the psychological barrier resistance 53.00, and with a closer look at the 60-minute chart, we find that the 50-day moving average is still holding the price from below, and the RSI indicator is stable above the 50 midline.

From here, with steady trading above 52.40 and the most important 52.20, the bullish scenario remains valid and effective targeting 53.20, and its breach is a catalyst that enhances the chances of the rally towards 53.70, and gains may extend later towards 54.10.

Trading below 51.80 cancels the suggested bullish scenario, and we witness a bearish path targeting a retest of 51.30.

Note: International Energy Agency on oil stocks are due today, which may have a significant impact on prices.

| S1: 52.20 | R1: 53.20 |

| S2: 51.80 | R2: 53.70 |

| S3: 51.30 | R3: 54.15 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations