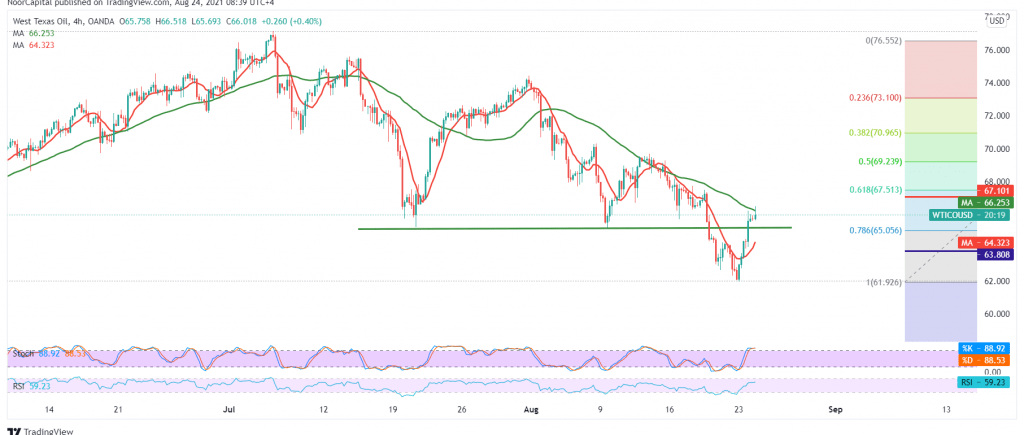

US crude oil futures prices jumped during the previous trading session within a bullish corrective slope after it succeeded in building a strong support level of 62.20.

Technically, positive signs are coming from the Relative Strength Index, and it’s gaining more bullish momentum on the short intervals, accompanied by the positive motive for the 50-day moving average.

Despite the technical factors that support the continuation of the bullish corrective bias, we prefer staying aside for the moment until a more accurate signal appears.

Activating long positions requires stability above the resistance level of the psychological barrier 66.00, extending the gains of oil so that we will be waiting for the next 67.00 station.

Activating short positions depends on the break of 65.00, which puts the price under negative pressure targeting 64.70. It should be noted that the confirmation of the last break constitutes a negative pressure factor on prices to be 63.80, the next target. Note: The level of risk is high.

| S1: 63.80 | R1: 67.00 |

| S2: 61.90 | R2: 68.20 |

| S3: 60.70 | R3: 70.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations