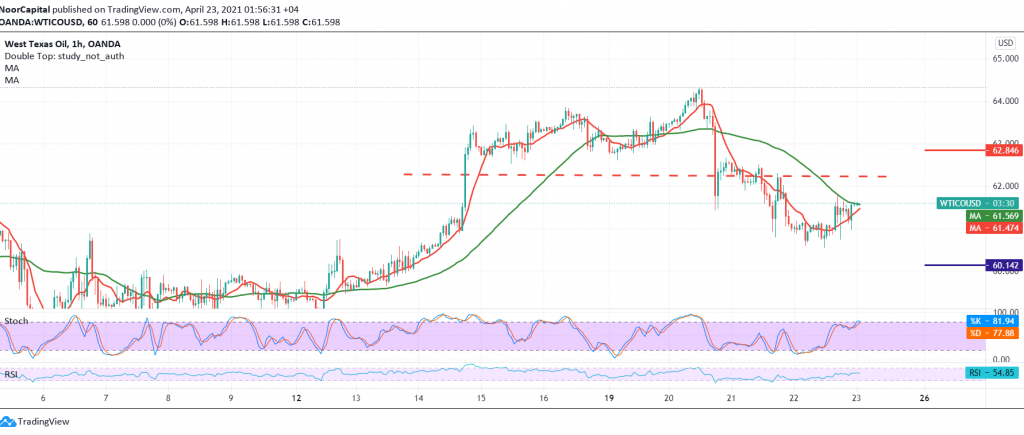

Negative trading dominated the US crude oil futures movements within the expected bearish context during the previous analysis, indicating that a break of 60.80 increases the negative pressure on the price to visit 60.40 to record its lowest price at 60.55.

Technically, the pressure coming from the 50-day moving average, in addition to the price’s stability below the extended pivotal resistance 62.00/62.20. It encourages us to maintain our negative expectations, provided that a break of 60.80 is confirmed, targeting 60.10, knowing that the last break will extend oil losses to visit 59.60 next official stations.

From the top, the return of trading to stability above 62.20 is capable of completely cancel the bearish scenario, and oil will recover again to visit 62.60, and gains may extend later towards 62.80.

| S1: 60.80 | R1: 62.10 |

| S2: 60.10 | R2: 62.60 |

| S3: 59.60 | R3: 63.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations