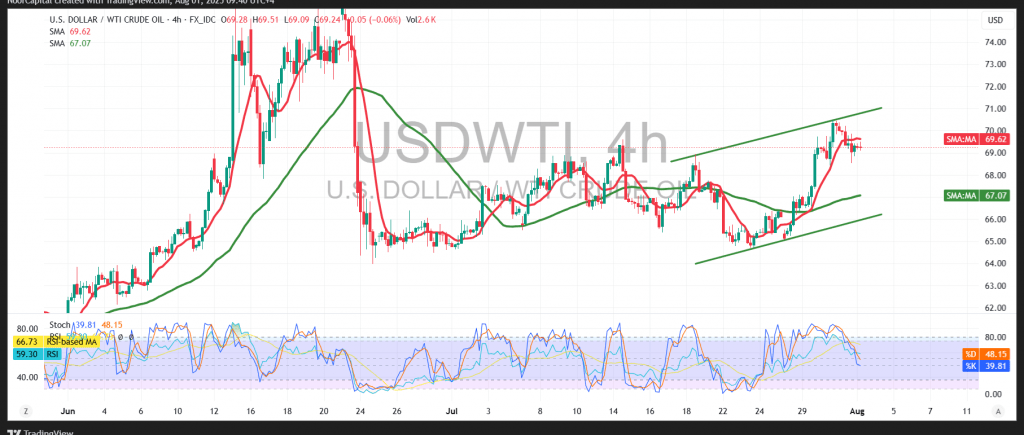

U.S. crude oil futures are attempting to preserve recent gains, in line with the bullish scenario outlined in our previous report. The price is gradually climbing toward the projected target of $70.70, having reached a session high of $70.40 per barrel.

Technical Outlook:

Current intraday price action is showing mild pullbacks, likely due to profit-taking after the recent upward leg. The Relative Strength Index (RSI) is working to clear overbought conditions, which could create room for renewed bullish momentum. Meanwhile, the price continues to hold above the key Simple Moving Averages (SMAs), which act as dynamic support and reinforce the ongoing bullish structure.

Probable Scenario:

As long as the price remains above the $68.70 support level—and more importantly, above the stronger support base at $68.45—the bullish trajectory remains the most probable scenario. A confirmed breakout above the $70.40 resistance level would likely drive prices toward $70.70, with the potential to extend further toward $71.20.

Alternative Scenario:

A break below $68.45 and a sustained close beneath it on the hourly timeframe could signal a shift in momentum, increasing downside pressure and potentially leading to a retest of the pivotal support zone near $67.65.

Key Risk Events – Volatility Alert:

Markets may experience heightened volatility today due to the release of key U.S. economic data, including:

- Non-Farm Payrolls

- Unemployment Rate

- Average Hourly Earnings

These indicators will play a critical role in shaping short-term market sentiment and U.S. dollar strength, both of which are major drivers for crude oil.

Warning:

Amid ongoing trade tensions and geopolitical uncertainties, risk levels remain elevated. Traders should prepare for sharp price movements in both directions and apply sound risk management practices.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations