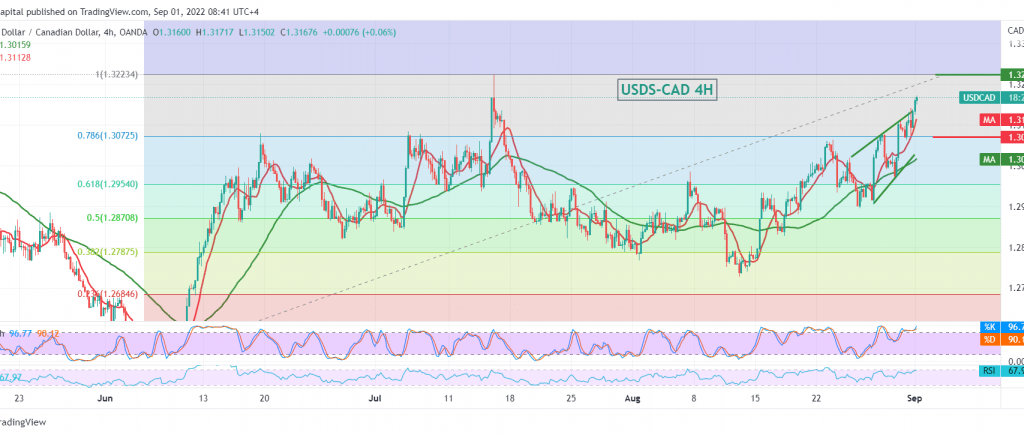

A bullish trend dominates the movements of the Canadian dollar within the expected positive outlook this week after the pair established a solid support floor of around 1.2860, achieving the required target yesterday at 1.3130 and heading to touch the second target of 1.3185.

Technically, the pair started its daily trading stable intraday above the resistance level of 1.3130, accompanied by the positive motive of the 50-day SMA, in addition to the pair getting bullish momentum signals on the short time intervals.

Therefore, we will complete our ascending targets, knowing that the consolidation above 1.3185 is a catalyst that enhances the chances of visiting 1.3210. Then 1.3245 next, as long as the price is generally stable above 1.3070.

Due to its significance for today’s trading, the pair’s price behavior should be carefully monitored around the 1.3185 resistance level.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations