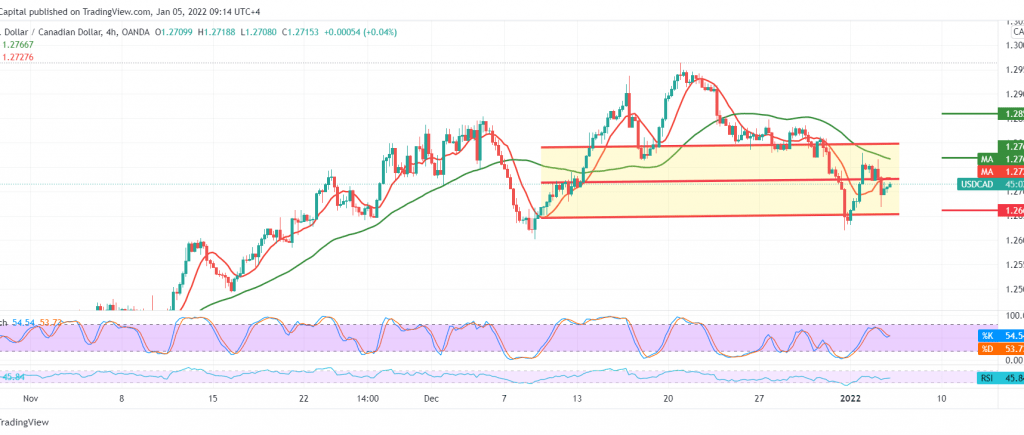

We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, explaining that activating the short positions depends on trading below the strong demand level of 1.2700. We are witnessing a negative trading session with the initial target of retesting 1.2640. CAD is recording its lowest price at 1.2667.

From the angle of technical analysis today, and with a careful look at the 4-hour chart, we can see negative pressure from the 50-day moving average accompanied by the loss of bullish momentum on the stochastic.

From here, trading below the pivotal resistance level at 1.2770/1.2760, preferring the bearish scenario, provided the price remains below 1.2700 to target 1.2665, and the price must be monitored well around this level because its break extends the pair’s losses, paving the way for retesting 1.2630.

Rising again above 1.2770 can thwart the above-suggested scenario, and the Canadian dollar will recover, so we are waiting for it to touch 1.2815 and 1.2865 following stations.

| S1: 1.2665 | R1: 1.2765 |

| S2: 1.2615 | R2: 1.2815 |

| S3: 1.2565 | R3: 1.2865 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations