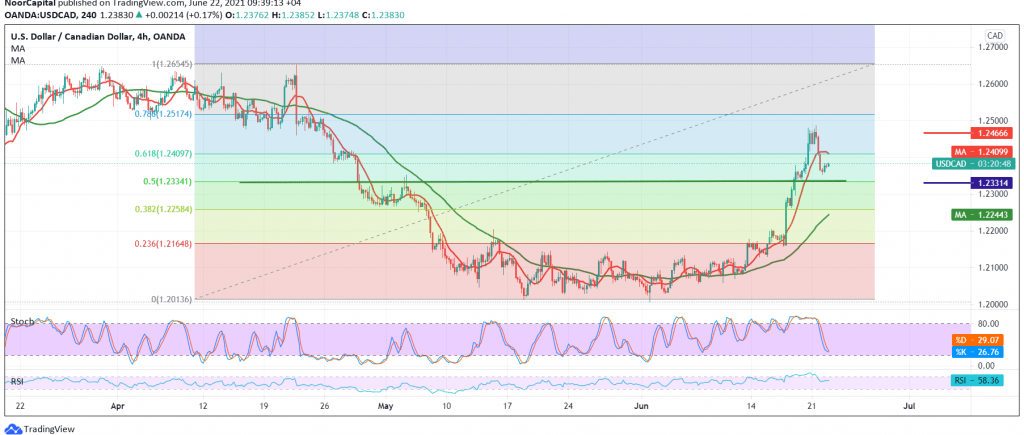

The Canadian dollar traded with the first trading of this week within a slight bearish slope, after several consecutive sessions of corrective ascent. From the point of view of technical analysis today, and with careful consideration of the stochastic indicator, we find that the indicator is clearly trading around oversold areas, which supports the idea of returning the bullish corrective slope again.

Therefore, with trading remaining above 1.2330, the bullish scenario remains valid and effective, knowing that the upside move and rise above the 1.2410 level, the 61.80% correction, is a catalyst that enhances the chances of rising with the first target of 1.2465, and then 1.2540.

The breach of 1.2330, the 50.0% correction, is able to thwart the bullish moves temporarily, and the pair is witnessing a bearish bias, with a target of 1.2280.

| S1: 1.2330 | R1: 1.2465 |

| S2: 1.2275 | R2: 1.2540 |

| S3: 1.2195 | R3: 1.2595 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations