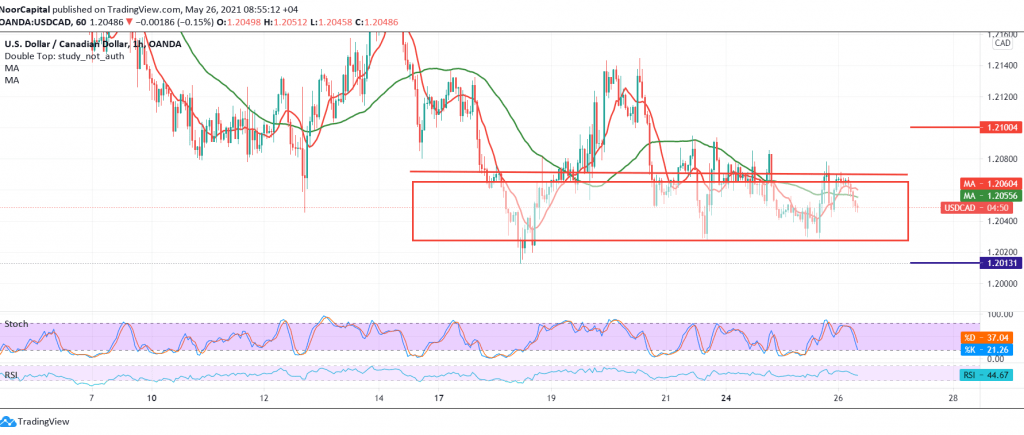

The technical outlook remains unchanged for the third session in a row, as the pair’s movements have not changed significantly within narrow-range sideways trades that tend to be negative.

Technically, trading remains below 1.2090 supports negativity accompanied by negative pressure coming from the simple moving averages, which coincides with the negative signs coming from the RSI on short intervals.

On the other hand, we find Stochastic trying to obtain positive signals that support the occurrence of a bullish corrective slope. With the conflict of technical signals, we will stand on the fence in order to obtain a high-quality deal, so that we are waiting for one of the following scenarios:

Reactivating long positions requires price stability above 1.2070/1.2075 to target 1.2105 and then 1.2130 while activating short positions requires us to witness a clear and strong break of the 1.2030 support floor, and from here the pair is exposed to strong negative pressure, the initial targets of 1.2000 and may extend towards 1.1965.

Note: The level of risk may be high.

| S1: 1.2030 | R1: 1.2100 |

| S2: 1.1990 | R2: 1.2130 |

| S3: 1.1965 | R3: 1.2170 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations