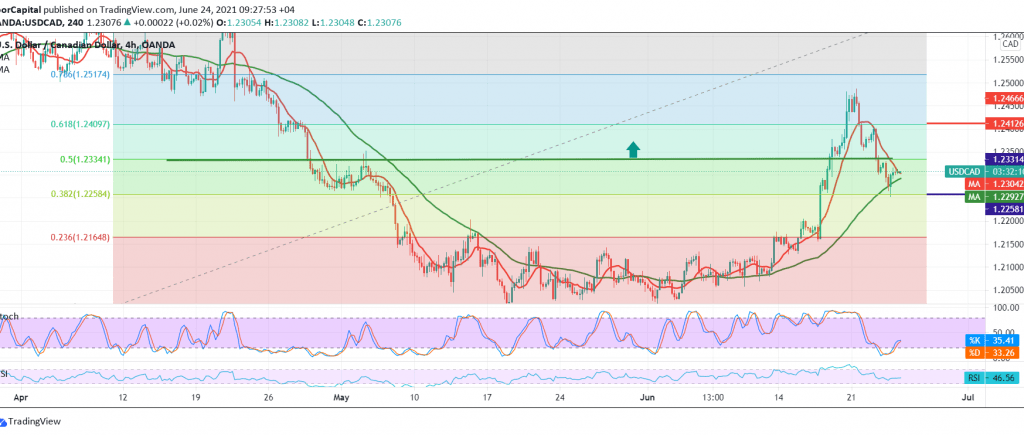

Negative trades dominated the movements of the Canadian dollar, and to remind you, we previously mentioned that trading below 1.2300 increases the possibility of retesting the 1.2260 support level before rising again to make the pair succeed in touching the published target, recording the lowest 1.2250.

Technically, the Canadian starts with a slight bullish bias, trying to retest the previously broken support, which is now turned to the 1.2330 resistance level, 50.0% Fibonacci correction. We tend to the possibility of a rise in the coming hours, relying on the positive signals coming from the RSI and its attempts to obtain bullish momentum.

Accordingly, the pair’s success in breaching 1.2330/1.2340 is a catalyst factor [it reinforced the chances of rising to visit 1.2375, followed by 1.2410, 61.80% correction.

Careful attention should be paid to the fact that the price stability above 1.2410 increases and accelerates the strength of the bullish corrective bias, with the aim of 1.2500 waiting station.

| S1: 1.2260 | R1: 1.2340 |

| S2: 1.2260 | R2: 1.2375 |

| S3: 1.2180 | R3: 1.2420 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations