We committed to the intraday neutrality during the previous analysis, indicating that the confirmation of a break of 1.2100/1.2090, with a clear breakout confirmation candle, extends the pair’s losses to visit 1.2065, to record its lowest level at 1.2075.

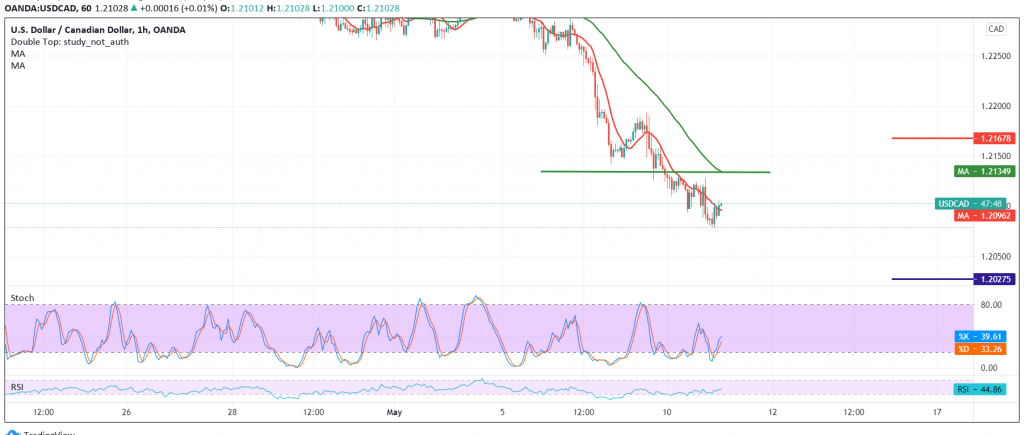

Technically, and with a closer look at the 60-minute chart, we find positive attempts for the Canadian dollar, taking advantage of building a base on the support level of 1.2065 in addition to the positive crossover signals that began to appear on the stochastic indicator.

Therefore, we may witness a bullish tendency in the coming hours, targeting a re-test of 1.2120, and then 1.2170. From the bottom, the return of trading to stability again below the support level of 1.2070 will stop any attempts for an upward correction and lead the pair to the downside path with the goal of 1.2020.

| S1: 1.2070 | R1: 1.2120 |

| S2: 1.2020 | R2: 1.2170 |

| S3: 1.1980 | R3: 1.2205 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations