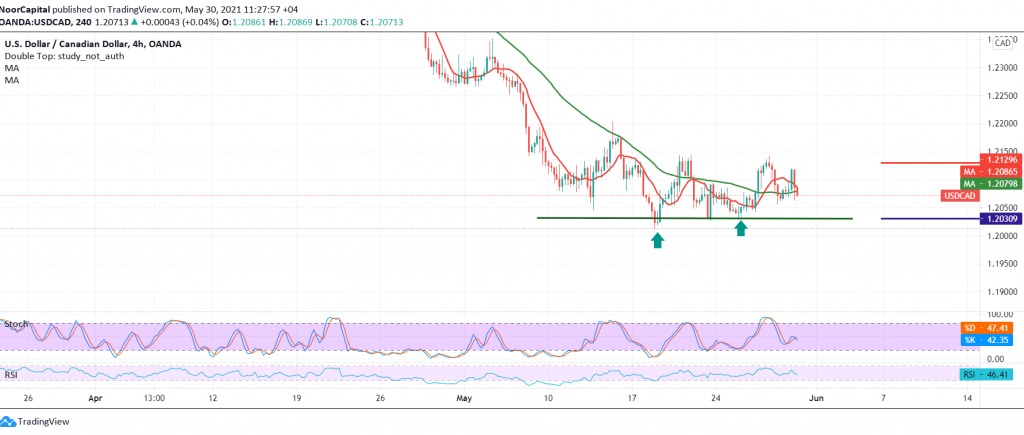

Sideways trading did not witness a noticeable change for the Canadian dollar within limited attempts to obtain a bullish corrective slope, touching our target of the first correction published in the previous report, 1.2130, to record its highest level at 1.2142.

Technically, the negative trades regained control of the pair once again, stable for the moment, below 1.2100, and in general below 1.2130.

Negative stochastic and the beginning of the negative pressure of the 50-day moving average supports the possibility of a reversal. Therefore, we are targeting 1.2030, and we should pay close attention if the mentioned level is broken due to its importance for the general trend in the short term, and confirming its break increases the possibility of touching 1.2000.

Skipping the upside and rising again above 1.2130 will lead the pair to enter a bullish corrective slope targeting 1.2175 and 1.2215, respectively.

| S1: 1.2030 | R1: 1.2130 |

| S2: 1.2000 | R2: 1.2175 |

| S3: 1.1950 | R3: 1.2215 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations