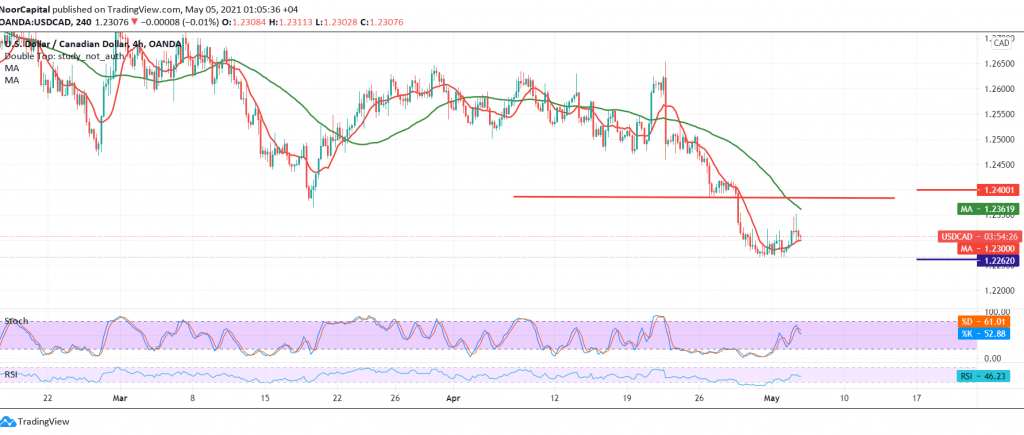

Tight sideways trading is still dominating the Canadian dollar, with little change, continuing in its attempts to stabilize above the support level of 1.2260.

Technically, and with a closer look at the 60-minute chart, we find the SMA 50 came back to pressure the price again and it still constitutes a strong obstacle to the consolidation stage, and on the other hand, the signs of oversold are clear on the stochastic indicator.

Therefore, we will stand on the fence for a while, in order to maintain profitability rates and to get a more accurate direction, so that we will be in front of one of the following scenarios:

To maintain the bullish corrective bias, we need stability in the price in general above 1.2260, and we also need to confirm the breach of 1.2310, in order to enhance the chances of the upside towards 1.2350, and then 1.2375.

The activation of short positions is confirmed with a break of 1.2250, which leads the price to resume the bearish path, with an initial target of 1.2200. Note: Risk is High

| S1: 1.2260 | R1: 1.2310 |

| S2: 1.2245 | R2: 1.2350 |

| S3: 1.2200 | R3: 1.2375 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations