The negative moves have returned to control the Canadian dollar’s movements, as we expected, explaining that a break of 1.2500 leads the pair to a downside path. Its initial target is around 1.2455, to settle for recording its lowest price during the previous trading session at 1.2476.

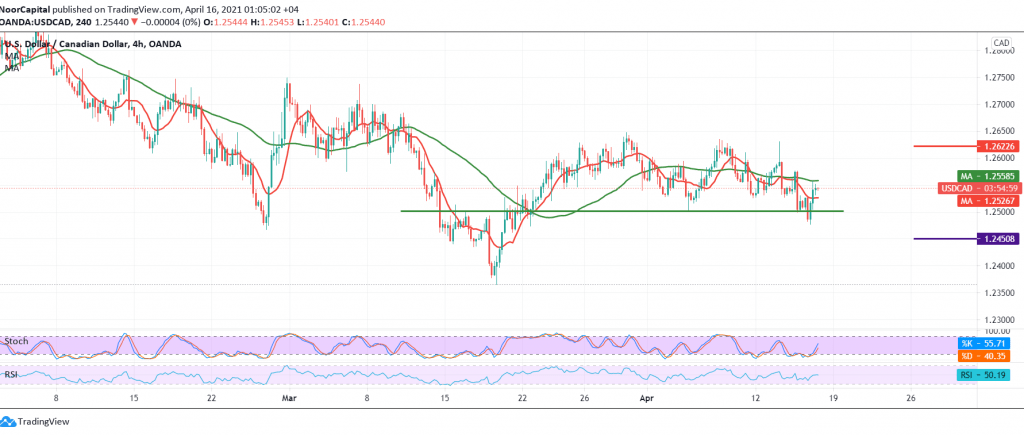

Technically speaking, the pair’s intraday trading is witnessing stability once again above the support level of 1.2500, accompanied by the clear positive crossover signals on the stochastic indicator.

Therefore, we may witness a slight bullish bias during the coming hours, aiming to re-test 1.2580 and 1.2620 respectively. Note that breaking 1.2500 and stabilizing below it will immediately stop the bullish corrective bias and put the price under negative pressure again, targeting 1.2455/1.2445, and then 1.2410 the next stop.

| S1: 1.2495 | R1: 1.2580 |

| S2: 1.2445 | R2: 1.2620 |

| S3: 1.2405 | R3: 1.2665 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations