Narrow sideways trading, but tilted to the negativity, dominated the Canadian dollar’s moves against its US counterpart, to re-test the pivotal support level at 1.3500.

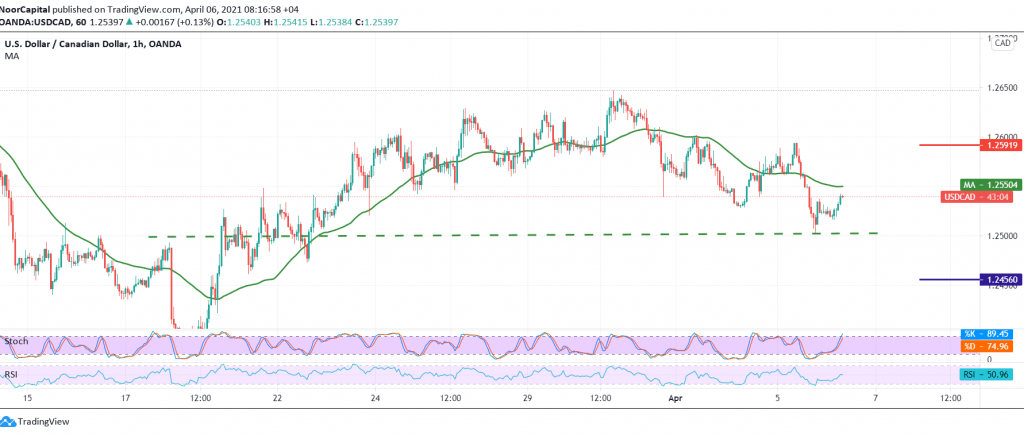

Technically, and with a closer look at the 60-minute chart, we find the pair trying to consolidate above the aforementioned support floor and the RSI indicator trying to obtain bullish momentum.

Therefore, we may witness a bullish trend during the coming hours, targeting 1.2590 first target, knowing that breaching it is a catalyst that enhances the chances of completing the bullish corrective bias with the second target of 1.2630.

From below, the confirmation of a breach of 1.2500, and the most important 1.2495 is able to completely defeat the bullish scenario, and we may witness a strong bearish bias, whose initial target is 1.2455 and may extend to 1.2410.

| S1: 1.2495 | R1: 1.2590 |

| S2: 1.2455 | R2: 1.2635 |

| S3: 1.2400 | R3: 1.2680 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations