Negative trading dominated the Canadian dollar’s movements yesterday within the expected bearish context, touching the first target to be achieved during the previous session at 1.2560, recording its lowest price of 1.2560.

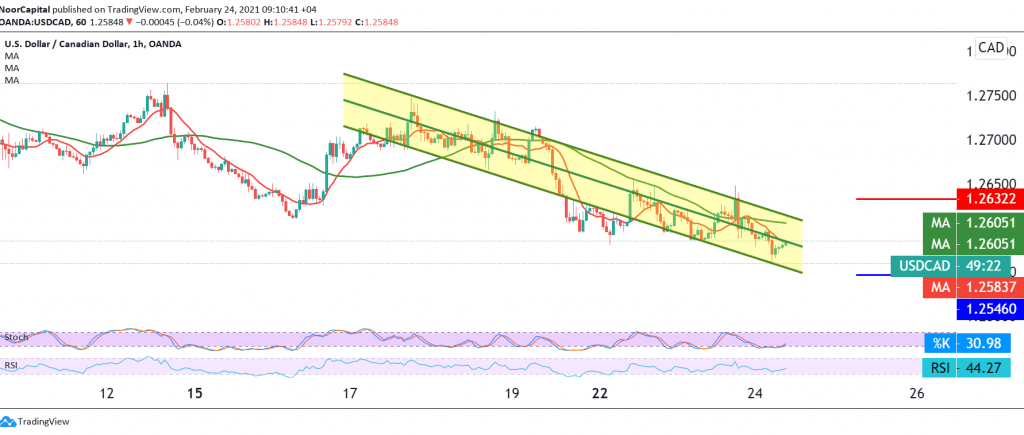

Technically speaking, and with a closer look at the 60-minute chart, we find that Stochastic started to provide positive crossover signals to push the price to rise, in addition to the stability of the intraday trading above the support level of 1.2560.

Therefore, we may witness positive movements over the next few hours, targeting a re-test of the 1.2630 resistance level.

The price must be monitored well in case the aforementioned level is touched, because the breach thereof is a catalyst that increases the possibility of touching 1.2680.

Note: the aforementioned slight bullish bias does not contradict the bearish trend, whose official targets are around 12510 once the break of 1.2560 is confirmed.

| S1: 1.2545 | R1: 1.2630 |

| S2: 1.2510 | R2: 1.2680 |

| S3: 1.2460 | R3: 1.2720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations