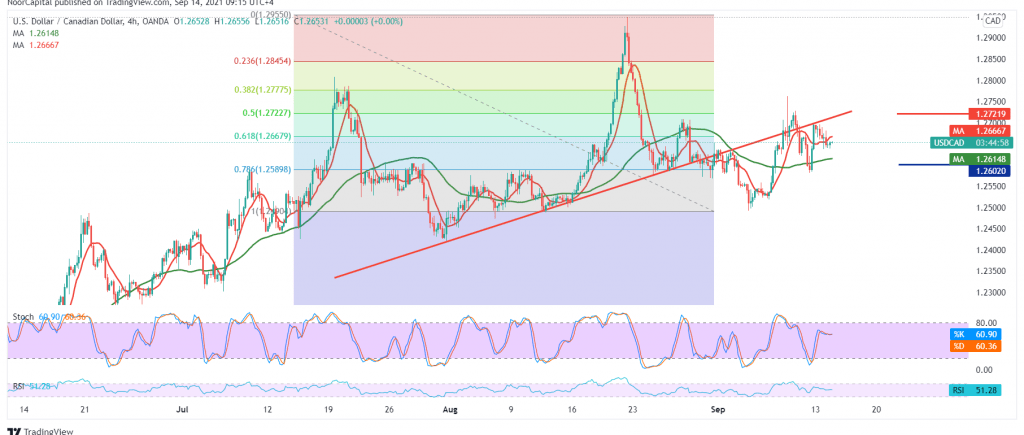

Trading tended to the negative, which dominated the movements of the Canadian dollar during the previous trading session after it found a strong resistance level around 1.2700.

Technically and carefully looking at the 240-minute chart, we find signs of negativity starting to appear on the stochastic indicator, in addition to the stability of the intraday trading below 1.2680.

Although we tend to be negative, we prefer confirming the break of 1.2600, which puts the price under strong negative pressure targeting 1.2545 and 1.2500, respectively, before attempts to rise again.

Climbing above 1.2680, most importantly, 1.2720 50.0% Fibonacci correction, could negate the bearish bias. We may witness an ascending path with an initial target at 1.2770 and a 38.20% correction, the gains will extend later towards 1.2840.

| S1: 1.2620 | R1: 1.2680 |

| S2: 1.2545 | R2: 1.2720 |

| S3: 1.2500 | R3: 1.2770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations