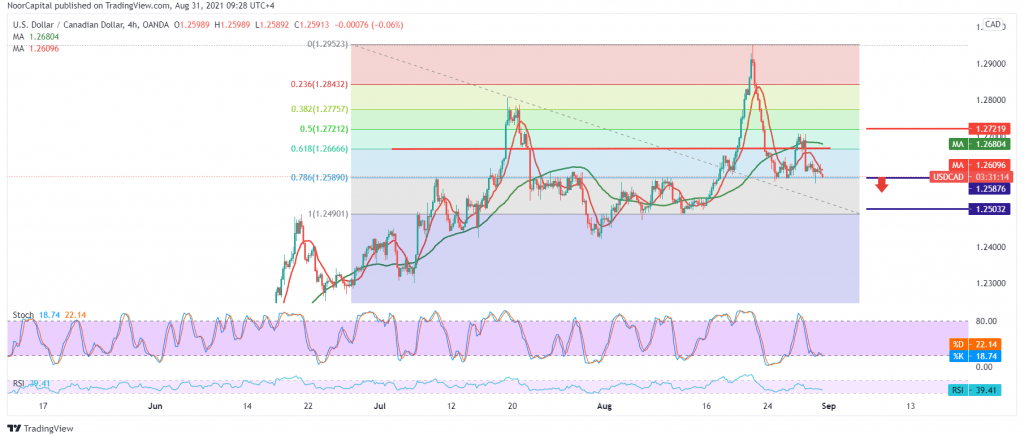

The Canadian dollar is struggling to maintain trading above the 1.2590 support level, which forced it during the last trading session to retest the 1.2635 resistance.

Technically, and by looking at the 4-hour chart, we find the 50-day moving average starting to pressure the price from above, accompanied by the RSI losing the bullish momentum.

Despite the technical factors that increase the possibility of a decline, we prefer to confirm the breach of 1.2580, and that leads the pair to a bearish path, with the aim of retesting 1.2540 and 1.2500, respectively, before attempts to rise again.

From the top, we have crossed upwards and rose again above the previously broken support and turned to the 1.2660 resistance level, the 61.80% Fibonacci correction, which will immediately stop the expected bearish bias and the pair will recover again, so we will be waiting for touching 1.2720, 50.0% correction.

| S1: 1.2580 | R1: 1.2685 |

| S2: 1.2540 | R2: 1.2745 |

| S3: 1.2480 | R3: 1.2775 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations