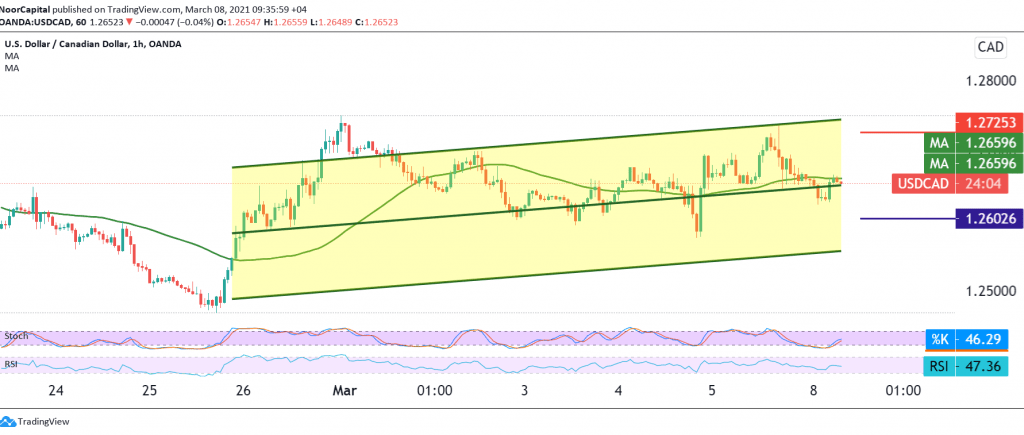

Positive trades are still dominating the Canadian dollar’s movements, maintaining the positive stability above the psychological barrier support level of 1.2600.

Technically speaking, and with a closer look at the chart, we find the RSI continues to obtain bullish momentum on short time frames, settling above the 50 midline, in addition to the pair’s attempts to stabilize above the 50 day moving average.

Thus, a bullish bias is likely today targeting the extended resistance 1.2700/1.2720 the first target, and a breach of it will enhance the chances of an upside move towards 1.2790.

Only from below is the return of trading stability again below 1.2600 capable of completely foiling the bullish scenario and putting the price under strong negative pressure, and its initial target is around 1.2555.

| S1: 1.2605 | R1: 1.2720 |

| S2: 1.2555 | R2: 1.2790 |

| S3: 1.2490 | R3: 1.2830 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations