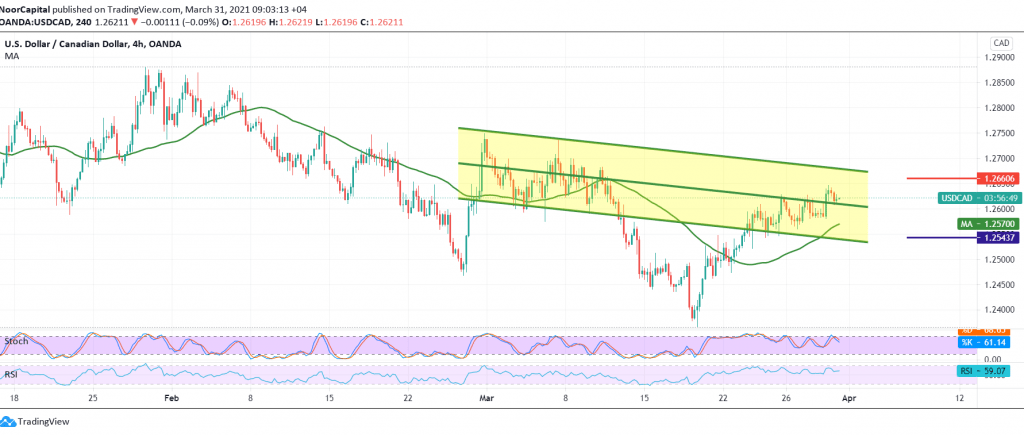

Narrow range sideways trading tends to be positive, and the Canadian dollar maintains the bullish context within the awaited bullish correctional trend.

From a technical analysis, we find that the pair managed to build an intraday above the support level of 1.2580, accompanied by the positive stimulus of the 50-day moving average that continues to hold the price from below, coinciding with the attempts of Stochastic to get rid of the current negativity.

We maintain the same positive outlook targeting 1.2650/1.2660 a first target, and then 1.2680 a second target, bearing in mind that trading above the last is a catalyst that enhances the pair’s gains, so the way is directly open towards 1.2720.

In general, we continue to suggest the bullish trend as long as trading is stable above the support floor of 1.2500 / 1.2480.

| S1: 1.2585 | R1: 1.2650 |

| S2: 1.2545 | R2: 1.2680 |

| S3: 1.2500 | R3: 1.2720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations