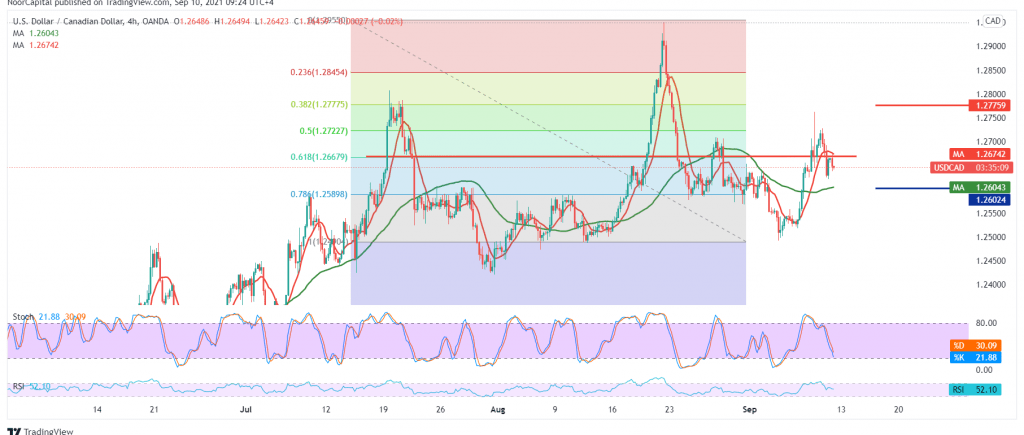

The Canadian dollar found a strong resistance level around 1.2720, which forced it to trade negatively again, settled below the 1.2660 level.

Technically, the negative pressure from the 50-day moving average supports the possibility of a bearish bias, in addition to stabilizing intraday trading below the 1.2665 resistance level represented by the 61.80% Fibonacci correction.

Therefore, we may witness a bearish bias in the coming hours, targeting a retest of 1.2600, and losses may extend towards 1.2560 before resuming the rise again.

Rising above 1.2665 will postpone the chances of a decline, and we are witnessing an ascending path whose target is 1.2720, 50.0% Fib.

| S1: 1.2600 | R1: 1.2720 |

| S2: 1.2560 | R2: 1.2770 |

| S3: 1.2500 | R3: 1.2820 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations