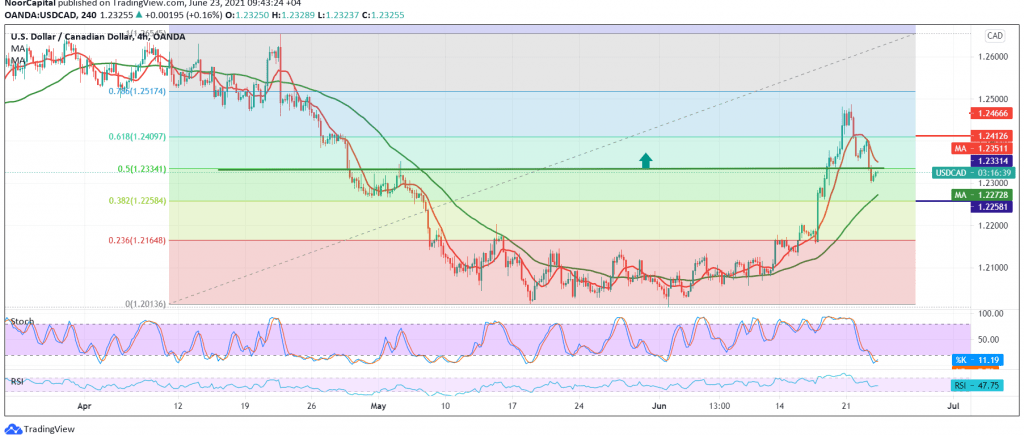

Negative trading re-dominated the movements of the Canadian dollar during the previous trading session, negates the positive outlook, as we expected, in which we relied on trading stability above 1.2330, to record its lowest level at 1.2301.

Technically, and with a closer look at the 4-hour chart, we find that the oversold signs are starting to appear on the stochastic indicator, with the 50-day moving average continuing to support it.

Although we tend to be positive, we need to witness price stability above 1.2330, 50.0% correction, and that might support the possibility of re-choosing 1.2410, 61.80% correction. It should also be noted that crossing above and rising above 1.2410 increases the strength of the bullish corrective slope to be 1.2500 the next station. . The return of stability below 1.2300 is leading the pair to a bearish path, with its target of 1.2260.

| S1: 1.2285 | R1: 1.2385 |

| S2: 1.2245 | R2: 1.2445 |

| S3: 1.2180 | R3: 1.2490 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations