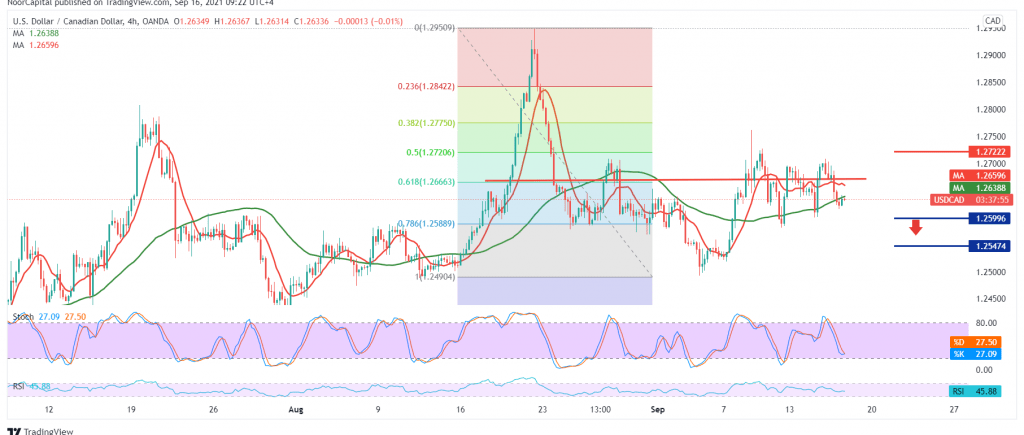

The current moves of the Canadian dollar are witnessing a bearish tendency after it found a strong resistance level near 1.2700, failed to settle above it for a long time within a bearish slope that aimed to retest the pivotal support 1.2600.

Technically, we find that it started moving below the 50-day moving average, in addition to stabilizing intraday trading below the 1.2660 level, the 61.80% Fibo as shown on the chart.

Although technical factors indicate the possibility of a bearish bias, we prefer to confirm breaking the 1.2600 support floor paving the way towards 1.2560 and 1.2520, respectively, before attempts to rise again.

If the pair succeeds in building the mentioned support 1.2600 and returns to trade above 1.2720, 50.0% Fibo, the pair will regain the bullish path with a target of 1.2770 and extend towards 1.2840.

| S1: 1.2600 | R1: 1.2720 |

| S2: 1.2560 | R2: 1.2770 |

| S3: 1.2510 | R3: 1.2840 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations