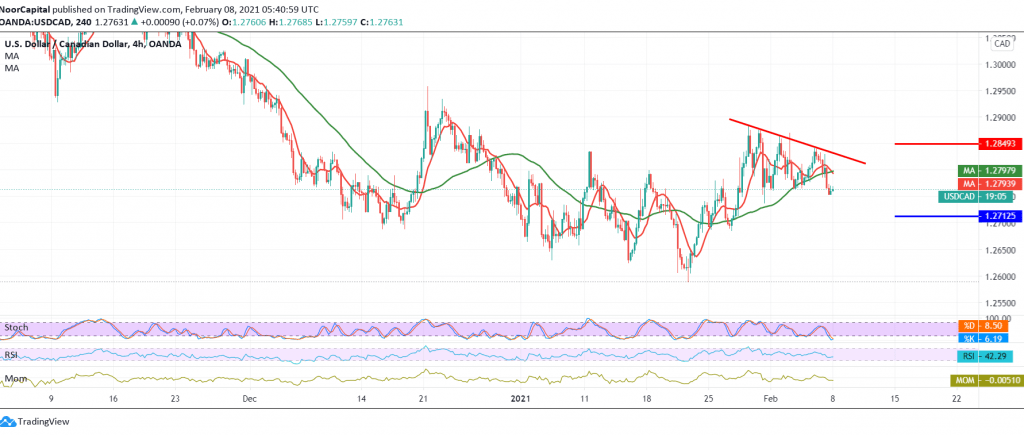

The Canadian dollar failed to maintain the trading level above the pivotal resistance at 1.2850, which was previously the first target of the aforementioned upward correction, as the current moves in the pair witness stability below the aforementioned level, in addition to the stability of intraday trading below 1.2790.

Technically speaking, there are signs of the beginning of the emergence of a bearish technical structure, as shown on the chart, and we find the 50-day moving average that continues to pressure the price from the top.

Therefore, the bearish bias may be the most likely today, targeting 1.2730 / 1.2710 as a first target. It should also be noted that trading below 1.2710 increases and confirms the strength of the daily bearish bias towards 1.2650.

From the top, to move upwards and stabilize again above 1.2810, and most importantly 1.2850 negates the bearish tendency, and the pair regains its recovery again to complete the upside correction to visit 1.2930.

| S1: 1.2730 | R1: 1.2810 |

| S2: 1.2700 | R2: 1.2860 |

| S3: 1.2650 | R3: 1.2890 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations