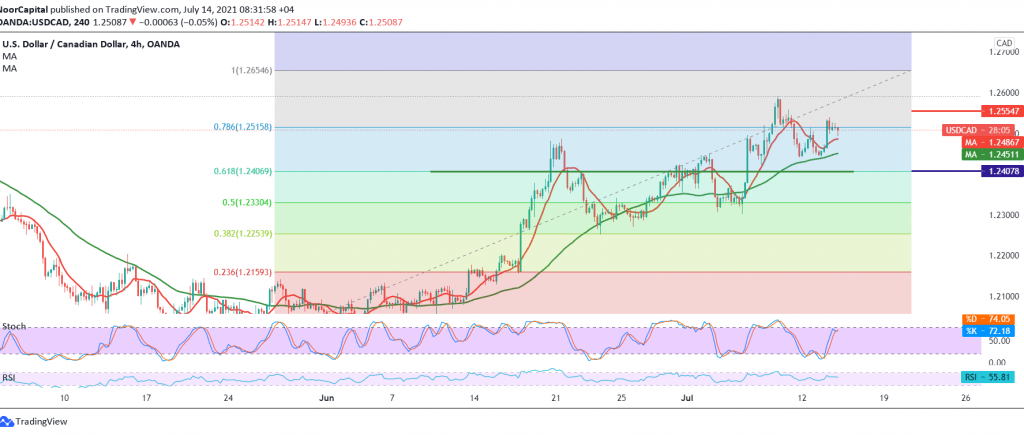

Positive trading dominated the movements of the Canadian dollar as we expected, in which we depended on successfully retesting the 1.2410 support level, approaching a few points from the first target of 1.2550, recording a high of 1.2540.

Technically, the bullish trend is still the most likely, relying on the positive motive coming from the 50-day moving average, which meets around the 1.2450 support level and the pair getting a positive signal from the momentum indicator on the short time intervals.

Therefore, we will resume the bullish correction tendency, with the first target of 1.2550/1.2555, and its breach is a catalyst that enhances the chances of rising towards 1.2600, and the gains may extend later towards 1.2650. Trading stability above the 1.2410 support level represented by the 61.80% correction is essential and fundamental for the rise to continue.

Note: Bank of Canada event is due today, followed by a press conference, and may cause high volatility.

| S1: 1.2455 | R1: 1.2555 |

| S2: 1.2410 | R2: 1.2600 |

| S3: 1.2340 | R3: 1.2650 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations