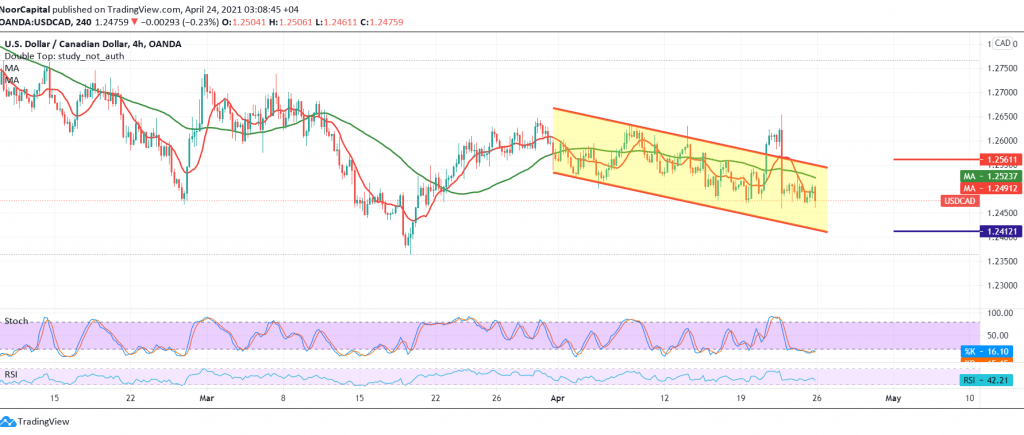

The Canadian dollar’s attempts -over several sessions in a row- failed to breach the pivotal resistance of 1.2550/1.2560 and settled below the aforementioned level.

Technically, and by looking at the 4-hour chart, we find the simple moving averages continue to pressure the price from below, and we find the RSI indicator began to gain bearish momentum.

Therefore, the bearish bias is the closest during today’s trading, targeting 1.2430 the first target, and then 1.2400/1.2380, respectively.

Activating short positions requires an intraday stability below 1.2520 and the most important 1.2550, noting that the breach of 1.2565 leads the pair to a bullish corrective path targeting 1.2600/1.2610.

| S1: 1.2440 | R1: 1.2520 |

| S2: 1.2400 | R2: 1.2565 |

| S3: 1.2370 | R3: 1.2605 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations