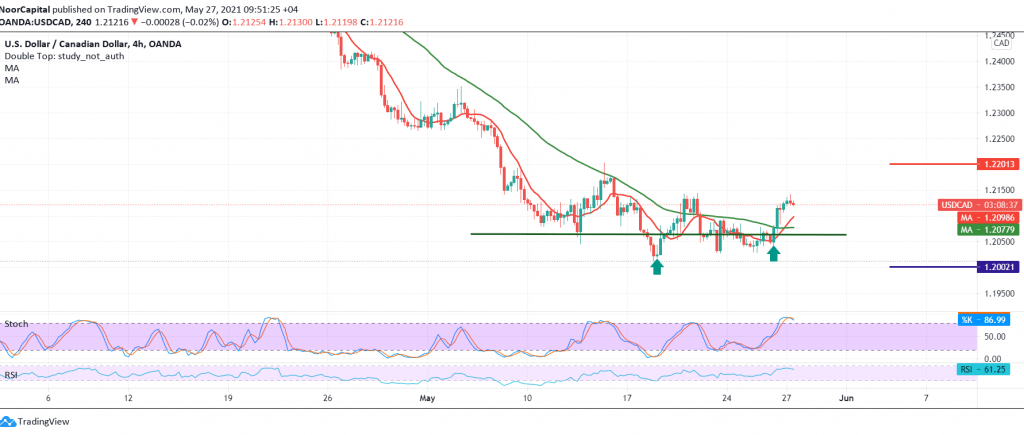

After several consecutive sessions of standing on the sidelines, the Canadian dollar’s movements witnessed an upward corrective tendency during the previous trading session, explaining that re-activating the long positions requires stability of the price above 1.2070/1.2075 to target 1.2105 and then 1.2130 for the pair to succeed in reaching its highest level at 1.2142.

Technically, we find the pair succeeded in building a base on the solid support floor 1.2030, as the intraday movements are witnessing stability above the resistance level 1.2070.

The 50-day SMA returned to hold the price from below, accompanied by the RSI’s attempts to obtain additional bullish momentum.

Thus, a bullish corrective bias is likely today, targeting 1.2160 the first target, knowing that breaching it is a catalyst capable of enhancing the chances of the upside towards 1.2200 and 1.2230, respectively.

A reminder that activating the bullish scenario requires an intraday stability above 1.2060, and in general above 1.2030.

| S1: 1.2060 | R1: 1.2160 |

| S2: 1.2000 | R2: 1.2205 |

| S3: 1.1965 | R3: 1.2260 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations