Positive attempts dominated the Canadian dollar’s movements during yesterday’s trading session, within the bullish context, as we expected, recording its highest level at 1.2340.

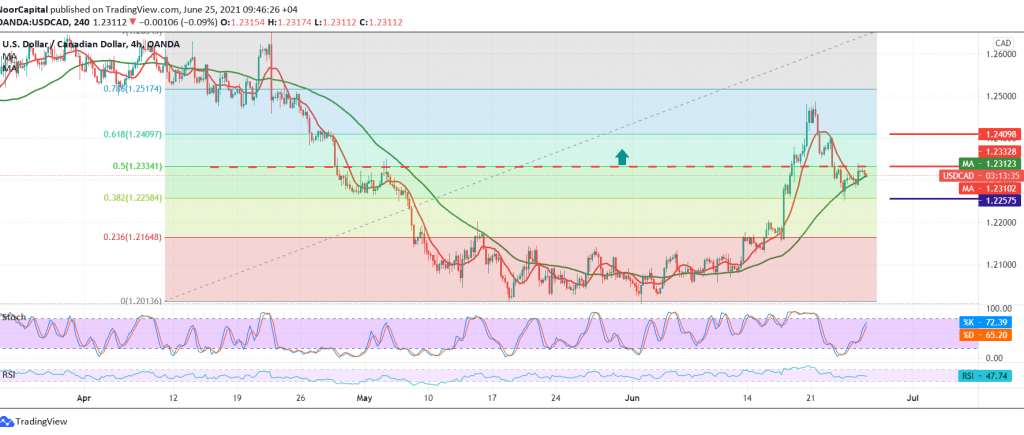

Technically, the Canadian starts with a slight bullish bias, trying to retest the previously broken support, which is now turned to the 1.2330 resistance level, 50.0% Fibonacci correction. We tend to the possibility of a rise in the coming hours, relying on the positive signals coming from the RSI and its attempts to obtain bullish momentum.

Consequently, the pair’s success in breaching 1.2330/1.2340 is a catalyst that enhances the chances of rising to visit 1.2375, and then 1.2410, 61.80% correction.

Careful attention should be paid to the fact that the price stability above 1.2410 increases and accelerates the strength of the bullish corrective bias, with the aim of 1.2500 waiting station.

| S1: 1.2260 | R1: 1.2340 |

| S2: 1.2215 | R2: 1.2375 |

| S3: 1.2180 | R3: 1.2420 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations