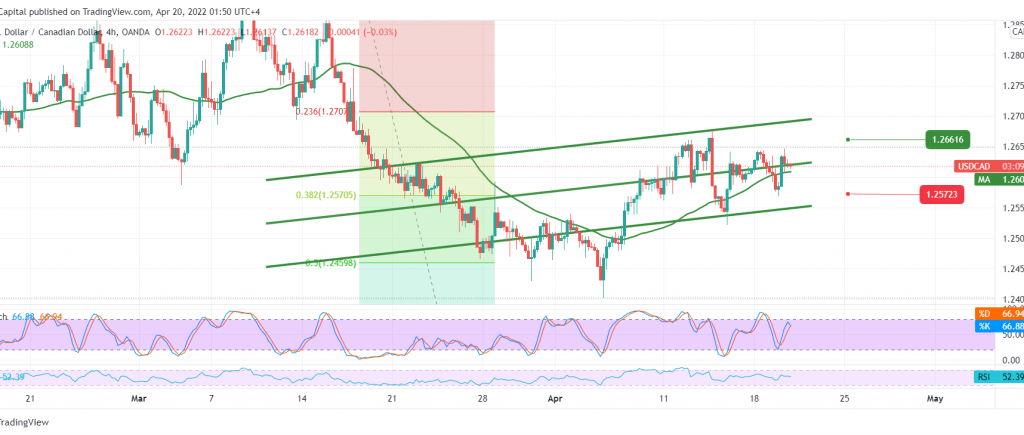

Positive attempts for the Canadian dollar continue but are still limited to finding a good demand area around the level published in the previous analysis at 1.2570, and the pair is still stable above it so far.

Technically, we find the 50-day moving average still holding the price from below and the price stability above 1.2570 at the 38.20% Fibonacci retracement, as shown on the 4-hour chart.

Therefore, we maintain our positive outlook, but with caution, provided we witness a breach of 1.2640, which is a catalyst that enhances the chances of rising towards 1.2660 and 1.2710, respectively.

Only from below, trading stability returns below 1.2570, 38.20% correction, which postpones the attempts to rise and puts the pair under temporary negative pressure, targeting 1.2540 and 1.2510 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations